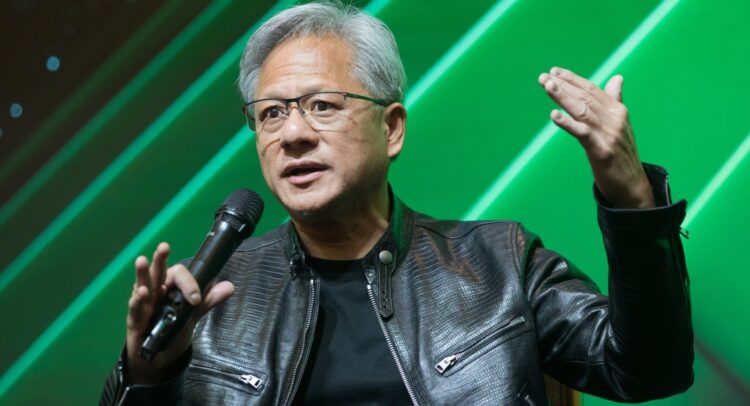

Chipmaker Nvidia’s (NVDA) stock surged over 8% yesterday, following bullish statements from CEO Jensen Huang. His optimistic remarks seemed to calm nervous investors who have been dragging down Nvidia shares since the company’s Q2 results and reports about the DOJ subpoena. NVDA shares led the rally in tech stocks yesterday on Huang’s comment about “stellar demand” for AI (artificial intelligence) chips.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Huang responded aptly to several questions asked by Goldman Sachs’ (GS) CEO David Solomon at the bank’s Communacopia and Technology Conference. Huang’s views were summarized by GS analyst Toshiya Hari and his team. Following the conference, Hari reiterated a Buy rating on NVDA stock with a price target of $135, which implies 15.5% upside potential from current levels. Hari is a five-star analyst on TipRanks, boasting an average return per rating of 24.1% and a success rate of 63%.

Huang’s Bullish Views on AI

Let’s take a quick look at the important takeaways from Huang’s statements.

- Customer ROI – Wall Street has recently been concerned about the return on investments (ROI) on hefty AI spending. Huang noted that even though Nvidia’s GPUs (graphic processing units) cost millions of dollars, they accrue immediate savings for customers in terms of money and efficiency. For instance, he said that setting up or renewing the traditional CPU infrastructure would cost millions more than Nvidia’s GPUs. Moreover, customers can increase their computing time by 20x and earn 10x of savings. Huang also stated that hyperscale customers can earn $5 in rental revenue for every dollar spent on NVDA infrastructure.

- NVDA’s Competitive Moat – Huang described Nvidia’s competitive moat in terms of its large installed base of GPUs, its ability to ramp up its hardware with software, its ability to build rack-level systems, and its solid capability to innovate the most advanced chips.

- Supply Chain Issues – Talking about supply chain issues, especially Nvidia’s close relationship with Taiwan Semiconductor (TSM), Huang acknowledged its partner’s contribution to the company’s outsized growth. At the same time, he noted that Nvidia has enough in-house intellectual property to manufacture its GPUs and can easily shift base without hampering the continuous flow of chips.

- Solid Blackwell Chip Demand – Huang said that the company is expected to start shipping large numbers of its next-gen processors Blackwell in Q4FY25 and scale supplies in Fiscal 2026. He asserted that demand for Blackwell products is robust and cited a sense of responsibility toward customers since it directly affects their revenues and competitiveness.

Is Nvidia a Buy, Sell, or Hold?

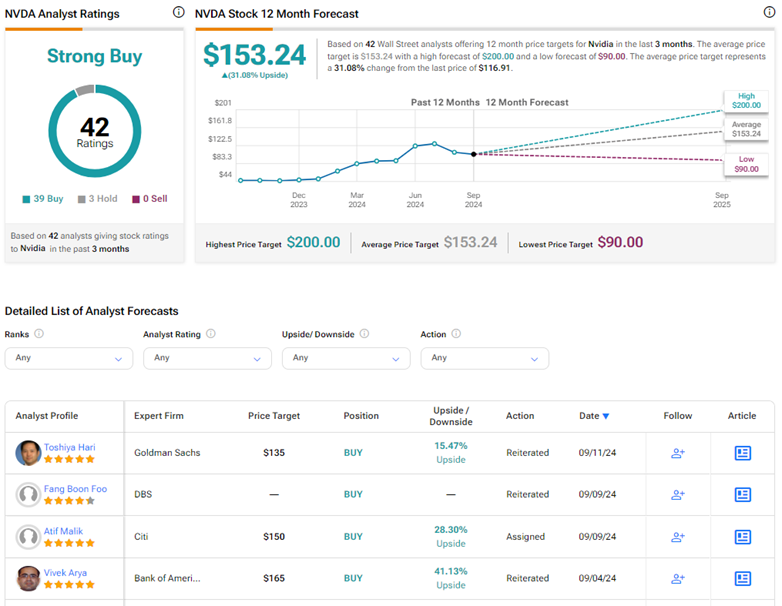

Nvidia undoubtedly has a large moat with its advanced AI chips and over 80% market share in the AI chip market, and Wall Street surely reckons that. On TipRanks, NVDA stock commands a Strong Buy consensus rating based on 39 Buys versus three Hold ratings. Also, the average Nvidia price target of $153.24 implies 31.1% upside potential from current levels. Meanwhile, NVDA shares have gained 136.1% so far this year.