Nvidia stock (NVDA) dropped 2.1% in pre-market trading to $184.41 on Tuesday after gaining nearly 3% the previous day. The decline followed rising geopolitical tension and growing competition in artificial intelligence chips, an area Nvidia has long dominated.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The market’s pullback came after China’s transport ministry said it was launching an investigation into a U.S. probe into the Chinese shipping sector, heightening concerns over a deepening trade conflict. The news hit semiconductor stocks broadly, with AMD (AMD) down 1.9% and Broadcom (AVGO) falling 2.9% in pre-market trading.

Broadcom’s OpenAI Partnership Raises Competitive Stakes

Investor focus shifted sharply to Broadcom after the company announced a 10-gigawatt AI accelerator partnership with OpenAI, a move that directly challenges Nvidia’s foothold in high-performance computing.

The announcement mirrors a similar deal Nvidia reached with OpenAI last month, under which Nvidia agreed to supply 10 gigawatts of AI infrastructure and invest up to $100 billion in the startup.

“This appetite for compute should drive others to increase capex spending forecasts since they need to compete too, so other Broadcom customers like Meta and Google are likely to spend more than expected,” wrote Melius Research analyst Ben Reitzes in a research note. “If you don’t have the compute, you don’t have a chance. To that end, Broadcom, Nvidia and AMD can all win.”

Reitzes’ comment underscores the paradox of the AI arms race. Competition is intensifying, but the overall pie for chipmakers continues to grow as hyperscalers pour billions into infrastructure.

Nvidia Expands Portfolio with DGX Spark Launch

In an effort to broaden its product lineup and push AI closer to developers, Nvidia unveiled the DGX Spark, which it calls “the world’s smallest AI supercomputer.”

The company said the compact system allows developers to create AI agents, programs capable of taking simple directions and completing multistep tasks, while running advanced models locally rather than relying on cloud infrastructure.

The launch fits into Nvidia’s strategy of embedding its hardware into every stage of the AI development process, from training large models in data centers to running inference tasks at the edge.

Many Analysts See the Pullback as Temporary

Despite the near-term dip, Nvidia remains one of the most heavily favored names among Wall Street analysts. The stock’s year-to-date rally, fueled by record AI chip demand and margin expansion, has left valuations stretched. This means geopolitical risks and competitive announcements can trigger sharper moves.

Still, many analysts see the pullback as temporary, arguing that Nvidia’s software ecosystem and developer dominance provide a long-term moat.

Is Nvidia a Buy, Sell, or Hold?

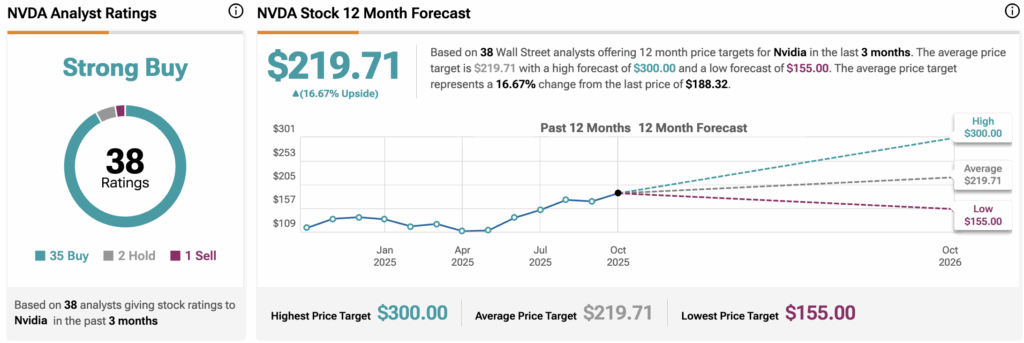

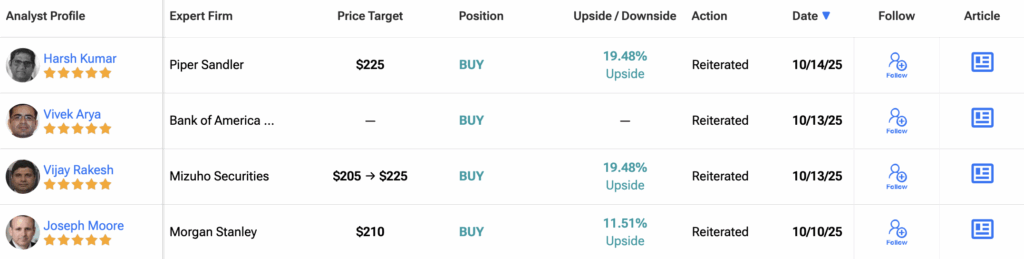

According to data from 38 Wall Street analysts, Nvidia carries a “Strong Buy” consensus rating. Of those, 35 rate the stock a Buy, two recommend Hold, and one suggests Sell.

The average 12-month NVDA price target sits at $219.71, implying a 16.7% upside from Nvidia’s latest close.

In short, Wall Street continues to view Nvidia as the defining player in the AI hardware boom, even as rivals like Broadcom and AMD race to capture a share of the same accelerating demand.