Nvidia shares (NVDA) are wrapping up a difficult week as investors pull back from AI stocks amid fresh concerns about funding needs and China’s market restrictions. The stock slipped 1.1% to $186.01 in premarket trading on Friday, extending a five-day decline of more than 7%. While Nvidia remains up roughly 40% for the year, short-term sentiment has clearly cooled.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Two themes drove the latest weakness. First, investors are growing uneasy about how much capital the AI industry will need to fund massive data center expansions. Second, Nvidia faces another setback in China, where it still cannot sell its high-end Blackwell AI chips.

OpenAI’s Comments Spark Funding Worries

New concerns surfaced after comments from OpenAI executives about the scale of spending required to build AI infrastructure. The company’s CFO said it would welcome a government “backstop” for its $1.4 trillion in planned investments. CEO Sam Altman later clarified that OpenAI does not want federal guarantees or any bailout. Still, the remarks drew attention to how dependent AI expansion is on massive, sustained funding.

Thomas Shipp, head of equity research at LPL Financial, said enthusiasm remains strong even as expectations rise. “While each dollar invested in AI raises the bar for the expected payoff, the momentum behind this theme is strong,” he wrote. “Earnings expectations are still growing; the synergies between AI and quantum computing remain unknown, and the current administration appears aligned with AI initiatives.”

China Market Is Still Closed Off

In a separate development, Nvidia CEO Jensen Huang confirmed there are “no active discussions” about selling Blackwell AI chips to Chinese customers, according to comments made in Taiwan. China has discouraged domestic companies from using Nvidia processors, and executives have already projected no Chinese revenue. This implies a hit of between $2 billion and $5 billion in potential sales per quarter.

Additionally, other chipmakers followed Nvidia lower. Advanced Micro Devices (AMD) fell 1.3% in premarket trading, while Broadcom (AVGO) slipped 1.1%. The moves reflect broader caution across AI hardware names as investors reassess how quickly large-scale projects can be financed and delivered.

Is Nvidia Stock a Buy, Hold, or Sell?

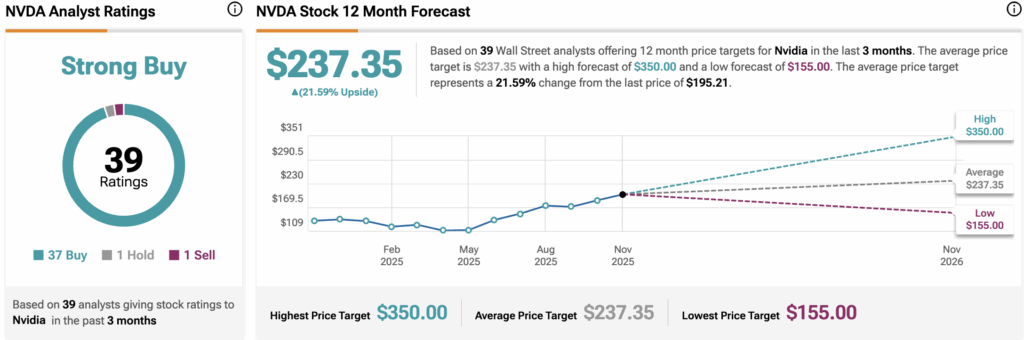

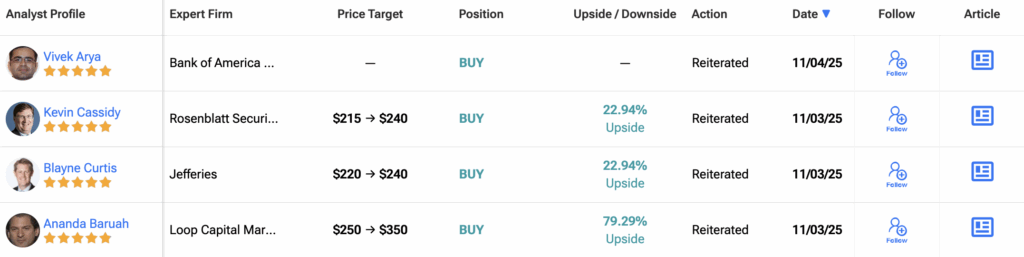

Wall Street remains broadly bullish on Nvidia (NVDA). Based on 39 analyst ratings over the past three months, the stock carries a Strong Buy consensus. Of the analysts surveyed, 37 rate the stock a Buy, one suggests a Hold, and one recommends a Sell.

The average 12-month NVDA price target stands at $237.35, implying a potential 21.6% upside from the latest closing price.