Chip giant Nvidia (NASDAQ:NVDA), which recently joined the trillion-dollar capitalization club due to its generative artificial intelligence (AI) capabilities, may not be without flaws. Recent research at the San Francisco-based Robust Intelligence firm found that NVDA’s system called “NeMo Framework,” which is based on its generative AI software, could expose customers’ sensitive information with some manipulation.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

As per a Financial Times report that cited the research, Nvidia’s safety restraints are not solid enough and could allow businesses to bypass the protective guardrails designed to safeguard the software. Robust Intelligence used the software on its own data sets to evaluate its safety. Based on the findings, the firm advised that its clients refrain from using the software. The generative AI software works on large language models (LLMs) to generate responses for simple queries such as customer service or general advice on investments.

More About NVDA Research Findings

Guardrails are security controls that provide developers the flexibility to work within the defined boundaries of security protocols and prevent misuse of the software. Per Robust Intelligence’s findings, it took only a few hours for the company to break through Nvidia’s preventive security controls by tweaking a few letters and accessing some of the personal information from a database. Nvidia has confirmed that it has addressed one of the underlying causes of the issues mentioned and that further efforts are necessary to fully resolve the matter.

Following the research, Nvidia’s vice president of applied research, Jonathan Cohen, stated that the open-source software was released to discover its potential and get appropriate feedback on it. Acknowledging Robust Intelligence’s findings, Cohen said that it “identified additional steps that would be needed to deploy a production application.”

The research displays the vulnerability of the AI space, which has the world going into a frenzy without realizing the potential danger that could arise from its misuse. Allowing the commercialization of such software needs to be done with the utmost care, as AI experts have lately cautioned about the hazardous consequences of fast-developing AI programs.

What is the Prediction for Nvidia Stock?

After hitting the trillion-dollar market capitalization and reverting, Wall Street analysts believe the stock is poised to break ground again. On TipRanks, the average Nvidia stock prediction of $449.92 implies 16.1% upside potential from current levels. This is despite the stock already gaining 170.9% so far this year. NVDA commands a Strong Buy consensus rating based on 32 Buys and four Hold ratings.

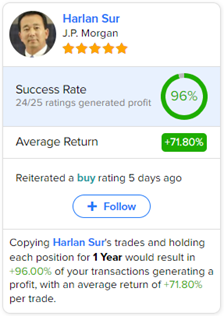

Further, investors looking for the most accurate analyst for NVDA could follow J.P. Morgan analyst Harlan Sur. Copying the analyst’s trades on this stock and holding each position for one year could result in 96% of your transactions generating a profit, with an average return of an impressive 71.80% per trade.