Nvidia (NVDA) has generated $112 billion in free cash flow over the past six quarters, giving it extraordinary firepower to shape the AI world. According to Gil Luria, a 5-star-rated senior analyst at D.A. Davidson, Nvidia is effectively acting as the “investor of last resort” in artificial intelligence. It is using its balance sheet to ensure demand for its chips continues to grow.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The approach is visible in both buybacks and customer financing. Nvidia has already spent $57 billion on repurchases since last year, authorized another $60 billion, and lifted R&D spending by nearly 40%. Even so, cash and short-term investments have risen for 11 straight quarters to reach $57 billion.

CoreWeave Shows How It Works

CoreWeave (CRWV) is the prime example of Nvidia’s strategy. What began in 2023 as a small AI cloud provider with $16 million in revenue has grown into an $80 billion company, thanks in part to Nvidia’s support. The chipmaker not only gave CoreWeave early access to servers and took a 5% stake, it also guaranteed a $6.3 billion backstop to buy unused data center capacity if demand fell short. This safety net encouraged lenders to provide new capital for expansion.

Nscale Becomes The Next Bet

In the United Kingdom, Huang has backed Nscale in a similar fashion. The start-up raised $1.1 billion with Nvidia’s involvement and signed deals with Microsoft (MSFT) and OpenAI for new deployments. During a launch video, Huang told CEO Josh Payne, “I have never seen a start-up take off like that before. I think you are on the Starship.” Payne responded, “We could not do so without your support.”

OpenAI Deal Raises The Stakes

Nvidia’s commitment of up to $100 billion to OpenAI takes the model to another level. The funds will help build 10 gigawatts of data center capacity, with Nvidia positioned to supply the hardware that powers them. The investment structure means that much of the money comes back to Nvidia through chip sales, while also securing equity in one of the world’s leading AI companies.

Critics call the structure circular, since Nvidia finances its customers who then spend heavily on Nvidia products. Yet the design virtually guarantees demand and cements its role at the center of the AI build-out.

Why The Strategy Is Successful

By becoming the investor of last resort, Nvidia is using its cash flows to keep the AI boom alive. The model ensures that customers remain funded, competitors are shut out of the biggest deals, and Nvidia itself captures the upside from both equity stakes and chip demand. It is a feedback loop that ties Nvidia’s fortunes directly to the survival and growth of the AI industry.

Is Nvidia a Buy, Hold, or Sell?

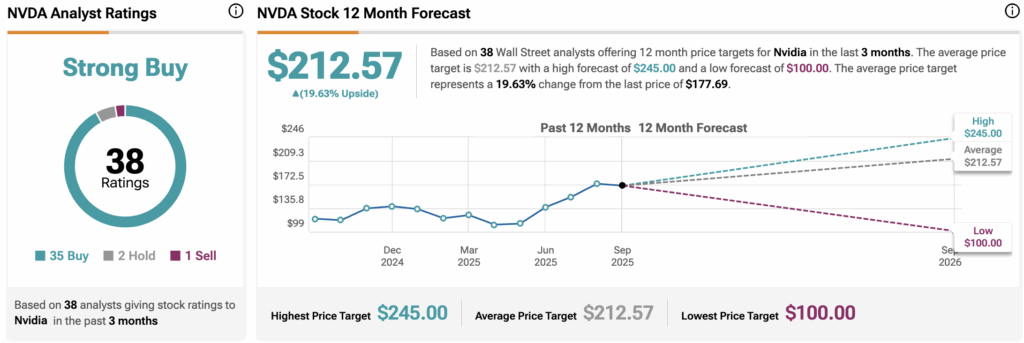

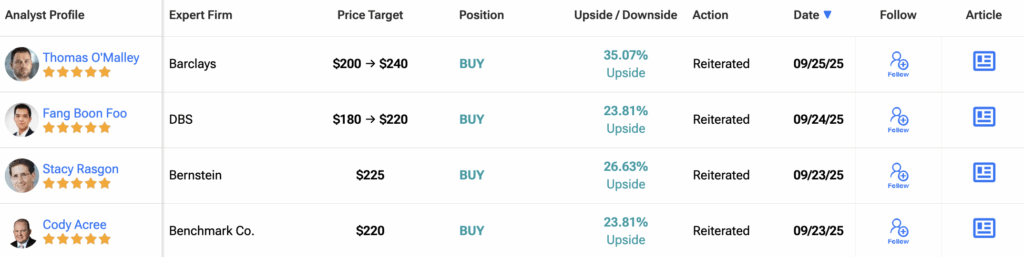

Wall Street remains bullish on Nvidia. Out of 38 analysts who issued ratings over the past three months, 35 recommend a Buy, two suggest a Hold, and only one has a Sell rating. The average 12-month NVDA price target now stands at $212.57, which is nearly 20% higher than the current share price.