Nvidia (NVDA) is reportedly planning to invest as much as $1 billion in the artificial intelligence (AI) startup Poolside to strengthen its foothold in the rapidly growing AI ecosystem. The investment also underscores Nvidia’s strategy of backing innovative companies that develop next-generation AI tools, complementing its own chip offerings. It seems investors are cheering the news, with NVDA stock up 0.53% as of this writing on Friday.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

On Wednesday, Nvidia briefly crossed the $5 trillion market valuation mark, driven by new partnership announcements at its annual GTC Conference in Washington, D.C. However, on Thursday, NVDA shares fell more than 2% after the Trump–Xi summit failed to deliver any updates on chip sales, dampening investor sentiment. Year-to-date, Nvidia stock remains up over 50%.

Nvidia Bets Big on Poolside

According to Bloomberg News, Nvidia’s planned investment of up to $1 billion in Poolside could quadruple the startup’s valuation, making it one of the largest recent bets in the AI space. For context, Poolside is a French AI company that develops powerful AI models to automate and enhance coding processes, helping users write and optimize software more efficiently.

Poolside is reportedly in talks to raise $2 billion at a pre-money valuation of $12 billion. Nvidia’s contribution is expected to begin at around $500 million and could rise to $1 billion if the startup reaches its fundraising goals. The reports further stated that Poolside has already secured over $1 billion in commitments, including about $700 million from existing investors.

Nvidia earlier backed Poolside in its $500 million Series B round in October 2024. Both Poolside and Nvidia declined to comment on the recent reports.

Why Nvidia’s Poolside Move Matters

Nvidia, which is already a major investor in AI startups, continues to diversify its portfolio across multiple sectors. The company’s Poolside investment highlights how the world’s most valuable company is helping build a growing network of AI startups that could also become key customers. One source said Poolside plans to use part of the new funding to buy Nvidia’s GB300 chips.

For Poolside, the deal supports its ambitious plans to expand AI infrastructure. Earlier this month, the startup announced a partnership with CoreWeave (CRWV) to build one of the largest data centers in the U.S.

What Is the Target for Nvidia Stock?

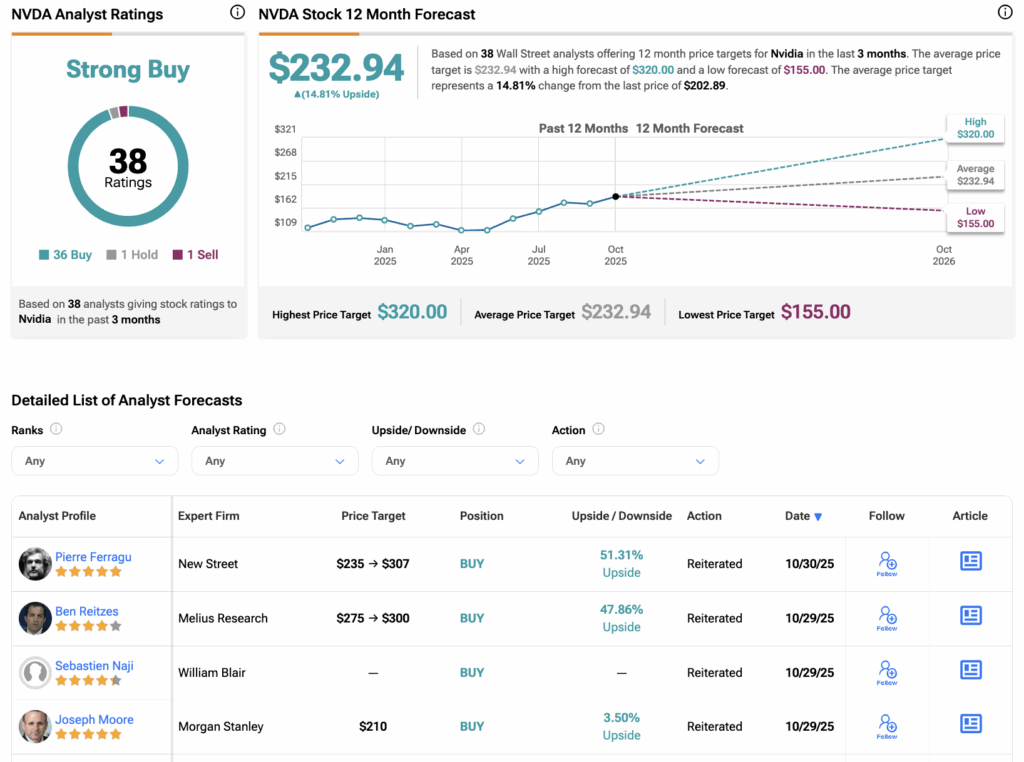

Looking ahead, NVDA stock has a Strong Buy consensus rating on TipRanks based on 36 Buys, one Hold, and one Sell assigned in the last three months. At $232.94, the Nvidia average share price target implies a 14.81% upside potential.