Nvidia’s (NASDAQ:NVDA) recent share dip, prompted by worries over a significant tech firm (believed to be Microsoft) reducing its demand for the H100 GPU, presents a prime “buying opportunity,” according to Morgan Stanley. Analyst Joseph Moore believes these concerns are exaggerated. He clarified that while he couldn’t discuss specific next-year budgets for individual clients, preliminary investigations indicate the demand for H100 GPUs is consistently outpacing supply across multiple regions and customers. Reports even suggest Microsoft needs more products than it’s currently receiving. As a result, shares are up at the time of writing.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Moore also highlights that Nvidia is now trading at a lower rate than other AI-focused competitors, even though Nvidia boasts a greater AI market presence. Moore’s key takeaway? Nvidia’s robust figures are poised to continue. If investors are anxious about immediate demand, this apprehension may soon be quashed, further solidifying Nvidia’s strong market position.

Is NVDA a Good Investment Now?

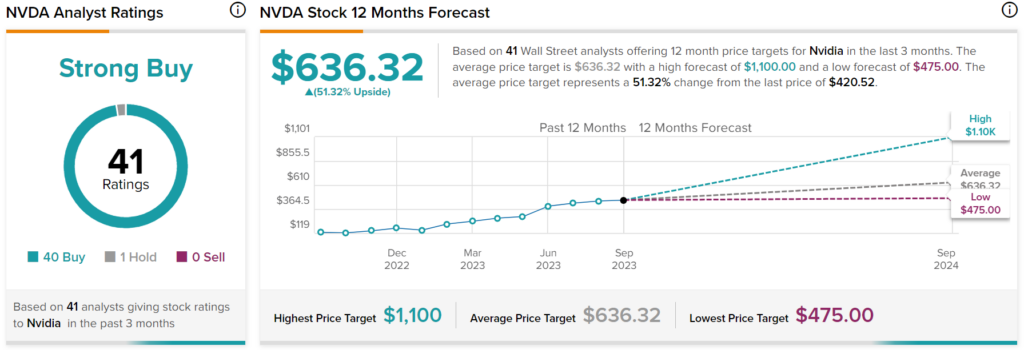

Overall, analysts have a Strong Buy consensus rating on NVDA stock based on 40 Buys, one Hold, and zero Sells assigned in the past three months, as indicated by the graphic above. Furthermore, the average price target of $636.32 per share implies 51.32% upside potential.