Nvidia (NASDAQ:NVDA) shares are drawing attention, jumping over 8% in today’s trading session. This uptick comes as Wall Street analysts increased their price targets for the company. HSBC’s Frank Lee and KeyBanc’s John Vinh are among those boosting expectations, hinting at potential underestimations in Nvidia’s forward earnings. They point to the tech giant’s unrivaled software capabilities and its prime position to harness the growth wave of artificial intelligence and data center advancements. Lee has a price target of $780 per share, while Vinh expects shares to hit $620.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In addition, Wedbush Securities analyst Dan Ives highlighted the mounting anticipation for the company’s outcomes, particularly as tech stocks face turbulent waters after second-quarter results. Ives projects a promising horizon for Nvidia, suggesting it might be the catalyst the tech sector needs, even with looming market anxieties tied to the Federal Reserve’s upcoming announcements. Current analyst consensus pegs Nvidia’s second-quarter earnings at $2.09 per share, with a projected revenue of $11.07B.

What is the Fair Value of Nvidia stock?

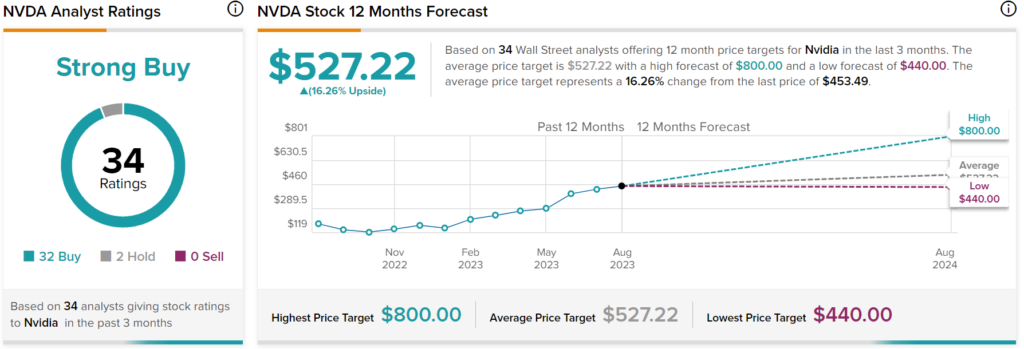

Turning to Wall Street, analysts have a Strong Buy consensus rating on NVDA stock based on 32 Buys, two Holds, and zero Sells assigned in the past three months, as indicated by the graphic above. Furthermore, the average price target of $527.22 per share implies 16.26% upside potential.