There were sobering remarks recently from chip stock Nvidia (NASDAQ:NVDA) CEO Jensen Huang. But a sober understanding of the situation never hurts. That and new chips, of course. Just ask Nvidia shareholders, who sent shares up nearly 1.5% in Monday afternoon’s trading session.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Nvidia Quickly Overcomes Chinese Export Ban

While the Chinese export ban on certain chips was likely to hit Nvidia right in the bottom line, most figured that Nvidia would promptly pivot to bring out a new kind of chip that would not only be purchased by the Chinese market but would also pass regulatory muster. Though, perhaps, some might not have expected such a pivot to occur quite so rapidly.

Now, Nvidia rolled out the H200, which is a GPU geared toward establishing and operating artificial intelligence models. The new chip is a bit unusual, as it boasts 141 gigabytes of what’s called “HBM3” memory. This will allow it to perform many common AI functions, from generating text and images to making predictions using models.

Meanwhile, Jensen Huang offered some commentary that demonstrates his own grasp of the situation. Huang noted that despite Nvidia’s incredible run-up over the last several months, any progress that it’s made in the field so far is inherently at risk.

Huang noted that “…there are no companies that are assured survival,” and even offered up some anecdotes about times in the past when Nvidia itself was almost at death’s door. The NV1, for example—Nvidia’s first chip—was a poor seller, and Nvidia nearly closed down after laying off half its employees. The RIVA 128, however—its third chip—turned things around. But Huang’s understanding of the environment does him credit and should help keep investors in the fold.

What is the Prediction for Nvidia Stock?

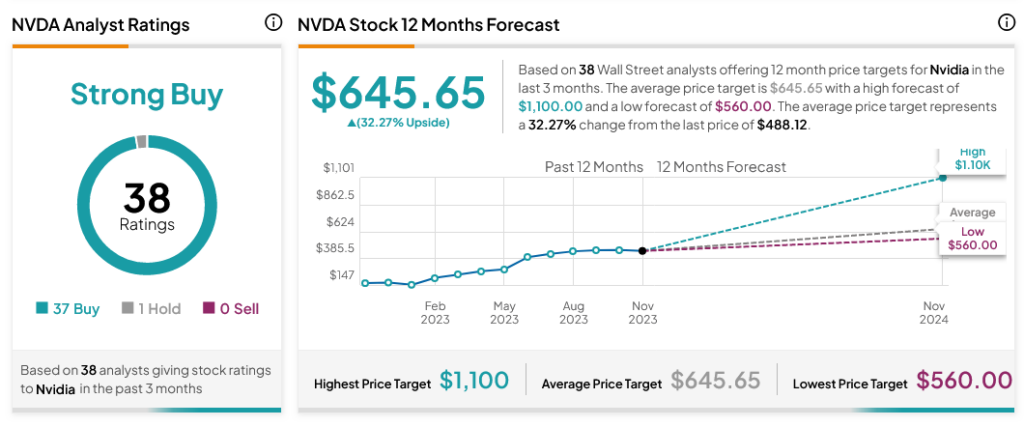

Turning to Wall Street, analysts have a Strong Buy consensus rating on NVDA stock based on 37 Buys and one Hold assigned in the past three months, as indicated by the graphic below. After a 200% surge in its share price over the past year, the average NVDA price target of $645.65 per share implies 32.27% upside potential.