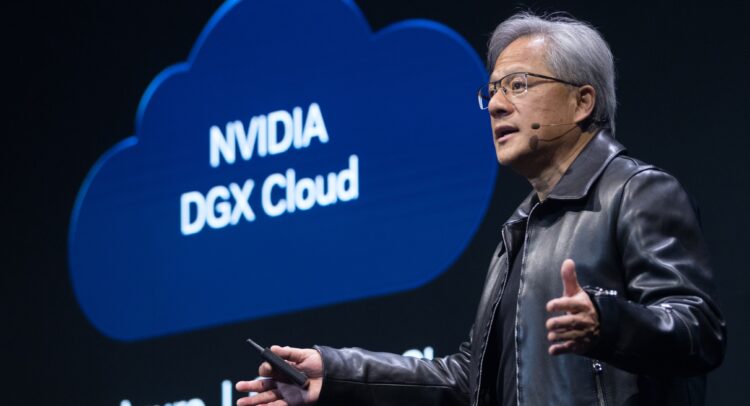

The term “as-a-service” has been added to a lot of technological concepts. Software, desktop functions, disaster recovery, infrastructure, and more—even artificial intelligence itself—have all landed the as-a-service treatment. Now, chip maker Nvidia (NASDAQ:NVDA), backed up by Equinix (NASDAQ:EQIX), has stepped things up to launch a completely cloud-based AI supercomputer system available on an as-a-service basis. The move struck a chord with investors, sending Nvidia shares up over 3% in Wednesday morning’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Now available, the service gives users access to AI supercomputing systems on a subscription basis instead of building and managing their own systems. With the Nvidia service, users can build and run their own AI models. Users get access to a range of levels of service that allow the closest tailoring to their own needs. It’s built around Nvidia’s DGX systems, as well as networking and the AI Enterprise platform. Meanwhile, Equinix handles the infrastructure side of things and will also deploy the services to its own data centers.

A Good Time for an Expansion Phase

This is a great time for Nvidia to start stepping things up. It recently lost the title of Top Pick at Morgan Stanley to Western Digital (NASDAQ:WDC), and that should prompt a new push for gains. Indeed, Nvidia is bringing in a lot of extra firepower, having recently inked deals with Recursion (NASDAQ:RXRX) and Amgen (NASDAQ:AMGN) to step up operations in the life sciences field. Nvidia will be bringing its AI tools to these fronts, which should only make it more valuable down the line.

What is the Target Price for NVDA?

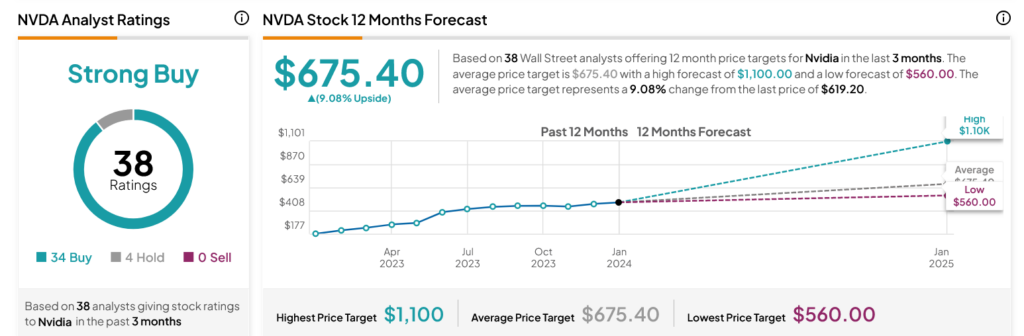

Turning to Wall Street, analysts have a Strong Buy consensus rating on NVDA stock based on 34 Buys and four Holds assigned in the past three months, as indicated by the graphic below. After a 219.47% rally in its share price over the past year, the average NVDA price target of $675.40 per share implies 9.08% upside potential.