Chip giant, Nvidia (NASDAQ: NVDA) along with Intel (INTC) could emerge as anchor investors for the UK chip maker, Arm’s IPO that could be listed as soon as September, according to a Financial Times report. Arm was bought by Japan’s SoftBank back in 2016.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

However, the prospective investors are still not in agreement with Arm over its valuation. According to the report, while Nvidia believes that Arm’s valuation should be in the range of $35 billion to $40 billion, Arm is of the opinion that it should be closer to $80 billion.

Nvidia had made a $66 billion bid for Arm back in 2020 but abandoned the bid last year following regulatory challenges. The launch of Arm’s IPO in New York would be to “help to support the stock as SoftBank, which bought Arm for £24bn in 2016, sells down its stake,” according to the Financial Times report.

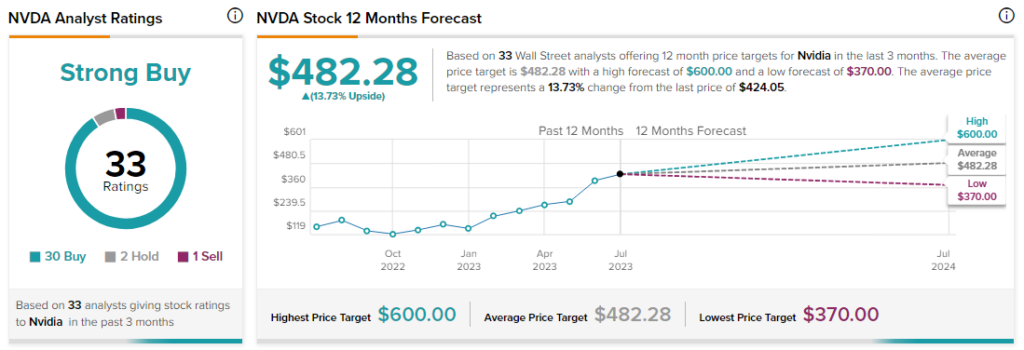

Analysts are bullish about NVDA stock with a Strong Buy consensus rating based on 30 Buys, two Holds, and one Sell.