Nvidia (NVDA) CEO Jensen Huang is taking a calm stance on the rising chip tensions between the U.S. and China. Speaking on Friday at the APEC CEO Summit in South Korea, Huang said both countries benefit from working together and described China as a “vital” and “irreplaceable” market for the global tech industry.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

His comments follow new U.S. export limits on high-end AI chips, which restrict Chinese access to Nvidia’s most advanced semiconductors. Still, Huang said he remains confident that demand from China will stay strong, adding that it’s “in everyone’s best interest” to keep technology trade open.

Huang Dismisses U.S. Security Fears on AI Chip Exports

Huang dismissed U.S. fears about selling AI chips to China, saying the issue is being overstated. He explained that China already makes many of its own AI chips and “has plenty” of homegrown technology. He added that China’s move to block Nvidia’s H20 chip shows it is no longer fully dependent on American designs.

When asked if Nvidia’s new Blackwell GPUs should be sold in China, Huang said he would like that to happen, but noted the final decision rests with President Trump. However, in an interview aired Sunday on CBS’s 60 Minutes, President Trump said he may block the export of Nvidia’s Blackwell chips, arguing that the U.S. should keep its most advanced AI technology within the country.

Nevertheless, Trump did not say whether his comments were directed at China in particular, but his stance could lead to tighter export limits that restrict access to Nvidia’s top products in several markets, including China.

China’s Tech Rise Keeps Nvidia on Its Toes

Huang also praised China’s growing tech strength, saying it would be “foolish to underestimate Huawei.” He called the company “extraordinary” in areas such as 5G, networking, and AI, adding that Huawei’s new CloudMatrix system shows how fast China is advancing in AI technology.

He said competition from China pushes Nvidia to move faster and keep improving its products. Huang estimated that China’s AI chip market could reach $50 billion this year and grow to a few hundred billion dollars by 2030.

Is Nvidia Still a Good Stock to Buy?

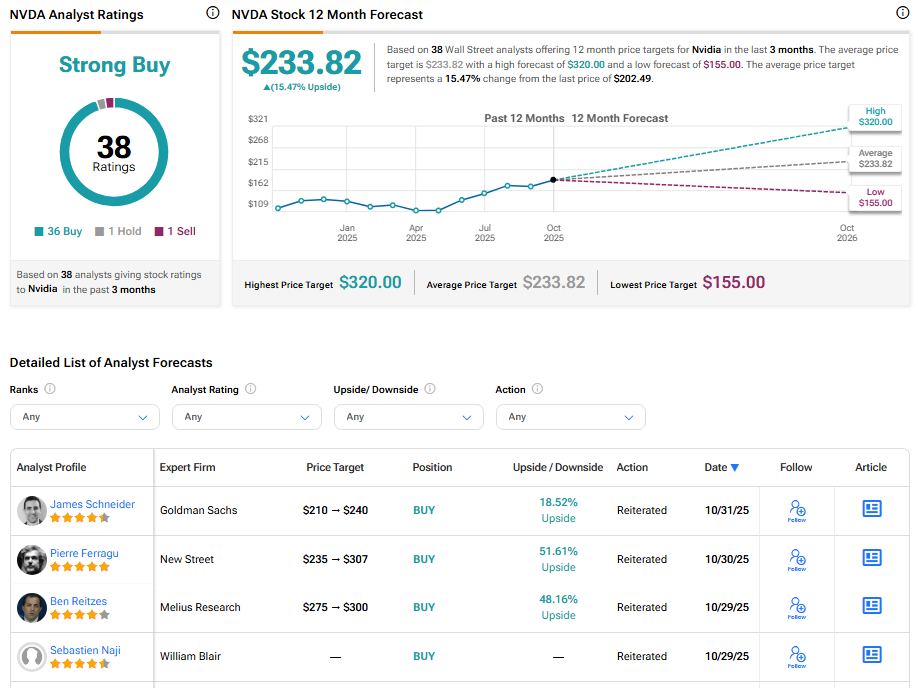

On TipRanks, NVDA stock has a Strong Buy consensus rating based on 36 Buys, one Hold, and one Sell rating. The average Nvidia price target of $233.82 implies 15.5% upside potential from current levels. Year-to-date, NVDA stock has surged nearly 51%.