Less than a year and a half ago, in November 2022, generative AI technology exploded onto the tech scene with the launch of ChatGPT – and the tech world is still trying to find its new equilibrium. Of course, that’s not the end-all, be-all. AI may be changing the tech and business landscapes, but it still depends on hardware, and someone still has to build those tools – and someone else will buy them. So the tech-hardware firms behind the AI boom are the AI stocks to look at for profits.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

That line of thought led Bank of America to look at Nvidia (NASDAQ:NVDA) and Super Micro Computer (NASDAQ:SMCI), two tech companies closely tied to AI. Nvidia makes semiconductor chips, the beating hearts of all AI systems; SMC makes the server systems that put AI-capable chips to work. These are indispensable niches in the rapidly expanding AI tech scene, and Bank of America’s analysts have tagged both these companies as some of the best AI-driven stocks to buy.

Unsurprisingly, both have shown powerful share growth in recent months, as AI-related companies have boomed. Let’s see why Bank of America believes they are poised for sustained success in the burgeoning AI market.

Nvidia

We’ll start with Nvidia, one of the world’s leading semiconductor chip makers – and one of the ‘Magnificent 7’ mega-cap tech companies that have been generating so many headlines recently. The chip maker’s shares have been appreciating at a rapid clip for several years now, easily outpacing the NASDAQ. NVDA is up by 234% in the last 12 months, and 56% just this year so far.

AI-capable semiconductor chips have been the main support for Nvidia’s recent gains and successes. The company has long held a reputation as a leader in high-performance chips, and was one of the first developers of the high-end graphic processor units (GPUs) that have proven essential across multiple computing sectors. Originally designed to meet the graphics needs of high-end gaming systems, these chips quickly found widespread application with professional graphic designers, in the data center industry, and, more recently, as the drivers of generative AI systems. Nvidia has built itself up as the leading provider of the high-capacity chips needed in all of these fields.

A review of Nvidia’s most recent financial results, released on Feb 21 for Q4 and fiscal year 2024, highlights the company’s growth supported by record-level performance. The company had a full-year top line of $60.9 billion, a company record that represented a year-over-year increase of 126%.

The quarterly revenue for fiscal Q4 2024 reached $22.1 billion, setting another company record. The Q4 top line was up 22% from the previous quarter, 265% from the previous year, and beat the forecast by $1.55 billion. The data center business was a particular bright spot in Nvidia’s quarterly success, showing revenue of $18.4 billion, 83% of the Q4 total, and growing 27% from Q3 and an impressive 409% from Q4 2023.

Nvidia’s earnings exhibited a consistent pattern of robust growth. The non-GAAP earnings-per-share in fiscal Q4 came to $5.16, marking a 28% quarter-over-quarter increase and a 486% year-over-year increase. The quarterly EPS was 52 cents per share better than had been expected.

In his latest research note on Nvidia for Bank of America, 5-star analyst Vivek Arya highlights several factors propelling the stock, notably the company’s significant involvement in various AI technologies and its diversified customer base, which is not reliant on any single firm or country.

“AI inference contributed nearly 40% of AI computing mix in FY24/CY23. AI inference is correlated with revenue bearing AI which is supposed to be more competitive, as opposed to AI training which NVDA already dominates. Second, we highlight the company’s positive commentary around tight supply, low China dependence (only mid-single digit percent of data center sales versus 20%-25% prior to restrictions), new pipeline, rising sovereign demand for AI among others. Overall, we raise CY24/25 EPS by +13%/15% vs. prior to $23.11/$29.59… Note, as data center growth remains robust from multiple demand drivers, we raise our l-t EPS target (CY27E) to roughly $45 from $40 prior,” Arya wrote.

Summing up, Arya gives NVDA shares a Buy rating, with a $925 price target that implies a 19% increase in the next 12 months. (To watch Arya’s track record, click here)

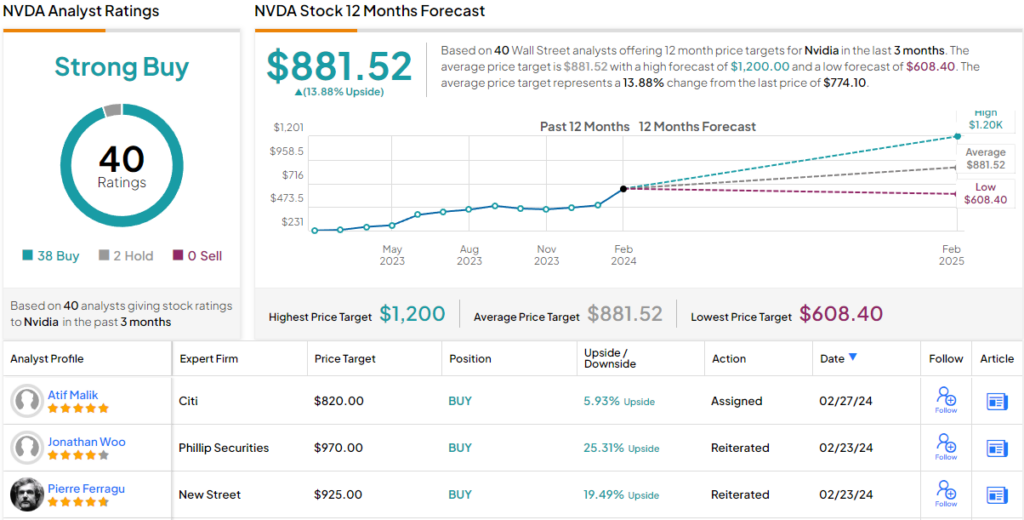

Overall, Nvidia’s stock gets a Strong Buy consensus rating from the analysts on Wall Street, a view based on 40 recommendations that include a decidedly asymmetrical split of 38 Buys to 2 Holds. The shares are trading for $775, and their $881.52 average target price suggests a potential upside of nearly 14% on the one-year horizon. (See Nvidia stock forecast)

Super Micro Computer (SMCI)

Next up is Super Micro Computer, the Silicon Valley information tech firm that provides server and storage solutions designed to meet the needs of a wide range of computational-intensive work systems. The company’s products are optimized for end-users’ applications and match high-performance computing needs with scalable installations. Super Micro uses its in-house build-out capabilities, including both design and manufacturing, to develop, build, and test a variety of server and storage systems, off the shelf and customized, including subsystems and unique accessory configurations.

This adds up to what the company calls an ‘unparalleled’ array of customer choices in multiple dynamic markets. Super Micro works in Edge/5G, data centers, both public and private clouds, and in the AI field, and backs up its server hardware architecture with a combination of top-level software and service. In addition to its reputation for high-quality server and storage solutions, Super Micro is also known in the industry for its push toward ‘green’ computing, based on its development and use of resource-saving architecture.

From its Silicon Valley headquarters, Super Micro operates around the world. The company has made itself a leader in its field and brought in $7.2 billion in total revenue for its fiscal year 2023. Super Micro’s in-house manufacturing facilities are extensive and exceed 6 million square feet across the global footprint of its factories.

This firm’s revenues, earnings, and share price have all been growing rapidly in recent months. The company reported $3.66 billion in revenue for fiscal 2Q24, beating the estimates by 103% and growing $400 million year-over-year. At the bottom line, the earnings came in at $5.59 per share by non-GAAP measures, 43 cents better than had been anticipated. Looking at the share price, we find that SMCI is up an extraordinary 755% over the past 12 months, and just in 2024 has racked up a whopping 195% surge.

Analyst Ruplu Bhattacharya covers this stock for Bank of America and explains how AI is driving demand growth for the company’s server products.

“We think this provider of server and storage solutions will be a beneficiary of AI-driven demand growth (>50% of revenues now tied to accelerators like GPUs). We believe the market for AI servers is much larger than is factored in Street models. We expect the market for AI servers to grow, on average, 50% CAGR over the next three years, vs. historical growth of the overall server market (5.5% CAGR over the past 17 years), and we expect Super Micro’s revenue to grow even faster driving market share gain. Super Micro has a growing backlog and is expanding capacity to support strong revenue growth. It has established itself as an early launch partner for companies like Nvidia, AMD and Intel for CPUs and GPU accelerators. And we think its ability to work with multiple new designs and technologies will serve it well as myriad AI-related processors debut in the next several years,” Bhattacharya opined.

These comments back up Bhattacharya’s Buy rating on SMCI shares, and his $1,040 price target points toward a one-year upside potential of 24%. (To watch Bhattacharya’s track record, click here)

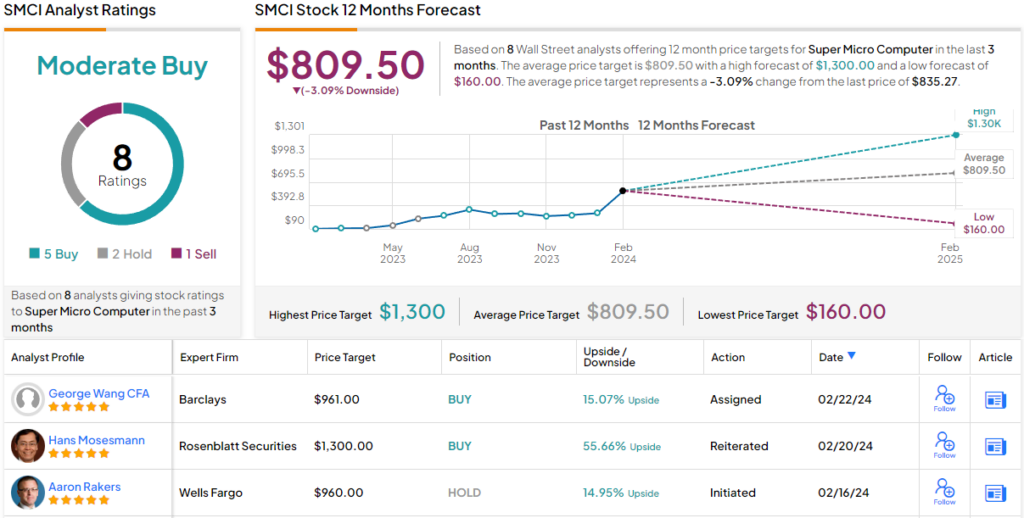

So, that’s Bank of America’s view, what does the rest of the Street have in mind? The current outlook offers a conundrum. On the one hand, based on 5 Buy ratings, 2 Holds, and 1 Sell, the stock has a Moderate Buy consensus rating. However, after soaring so high this year, the analysts expect shares to cool down and anticipate downside of a modest 3% from current levels. (See SMCI stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.