The AI trade got new fuel this week. OpenAI’s Sora video app raced up Apple’s (AAPL) charts and the company struck supply deals with Samsung Electronics (GB:SMSN) and SK Hynix. This combination revived talk of a bigger data center buildout and faster ramps for advanced memory. Investors are reading it as more orders for accelerators and networking.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

OpenAI’s private valuation now sits near $500 billion after an employee share sale, according to multiple reports. This step-up eases some of the chatter around Nvidia’s (NVDA) up to $100 billion commitment to OpenAI because it points to third-party confidence in the business footing the bill for all that Nvidia hardware.

Chip Stocks Extend Gains

Nvidia (NVDA) ticked 1.3% higher in pre-market trading to $189.70. Advanced Micro Devices (AMD) added 2.8%. Broadcom (AVGO) gained 1.9%. The move follows a short bout of doubt about returns on AI spend. This doubt looks on hold as app momentum returns and the supply chain leans in.

Memory names rallied overseas as well. SK Hynix jumped 9.9% and Samsung climbed 3.5% in local trading after the OpenAI partnerships. More bits shipped and more high bandwidth memory online generally translate into more GPU deployments.

Nvidia Reinvests Cash and Builds Moats

Bulls argue Nvidia can fund the next leg without starving shareholders. “Nvidia is poised to generate well over $600 billion in free cash flow over the next 3.5 years,” wrote Melius Research analyst Ben Reitzes. “We used to think they’d have no choice but to announce the biggest buyback program ever—but now we wouldn’t be surprised if just 20% of that cash went to buying back stock. Instead, [Nvidia CEO] Jensen [Huang] is going to use cash to invest in his ecosystem to help grease the AI flywheel.”

This strategy is important because circular concerns around vendor financing fade if the ecosystem compounds. New customers, more capacity, and tighter platform lock-in pull through more software and services over time.

What to Watch Next

Keep an eye on the Sora user curve and on any updates to OpenAI’s data center roadmap. Watch memory supply ramps at Samsung and SK Hynix and any signs that high bandwidth memory constraints are easing. Track Nvidia’s capital allocation mix between buybacks and ecosystem investments as checks land and orders convert.

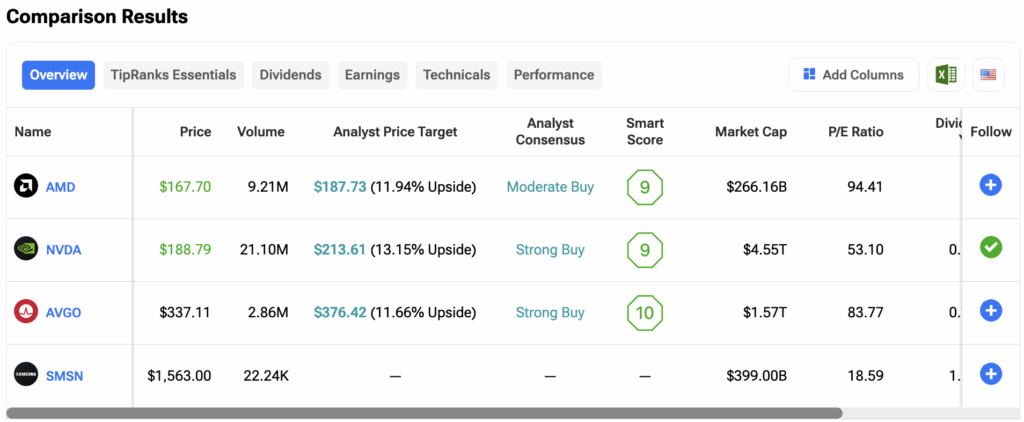

Investors can compare the stocks mentioned in the article side-by-side on the TipRanks Stocks Comparison tool.