The AI revolution continues to reset industries and market expectations. Remarkably, Nvidia (NASDAQ:NVDA), a frontrunner in AI, consistently surprises analysts with its robust growth trajectory, propelling valuations to unprecedented heights.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Nvidia’s stock has more than doubled this year, and its latest earnings release was eagerly anticipated on Wall Street. Unsurprisingly, the megacap delivered yet another impressive performance, leaving investors far from disappointed.

In fiscal Q1, Nvidia surpassed projections with revenues reaching $26.04 billion, outstripping the forecast by $1.45 billion. Meanwhile, the EPS soared to an impressive $6.12, beating expectations by $0.54. Looking ahead, the company anticipates fiscal Q2 to achieve revenue of $28 billion, exceeding analysts’ predictions of around $26.8 billion.

The market rewarded the AI chipmaker, with shares bursting above $1,000. A 10 to 1 stock split this summer is also generating excitement, as the reduced price should provide a realistic entry for more retail investors to stake a position.

With demand outpacing supply, Nvidia is showing no signs of slowing down. On the contrary, the company is looking to diversify its customer base beyond the four hyperscalers which supply some 40% of its business.

TD Cowen’s Matthew Ramsay, a 5-star analyst rated in the top 1% of the Street’s stock pros, firmly believes in Nvidia’s ongoing success. He goes as far as to label Nvidia as his ‘Best Idea’ for 2024, showcasing his strong confidence in the company’s future performance.

“NVIDIA’s results and guide leave us more confident that NVIDIA remains the leader in accelerated computing… The suite of superior technology, long pedigree of innovation, and extensive growth-oriented investments should allow for strong, sustained, above-peer growth across a widening set of verticals,” Ramsay opined.

The top analyst is particularly bullish on Nvidia’s “broadening set of verticals,” with a growing set of customers for “the company’s recently launched H200 and soon-to-ship Blackwell-based suite of systems.”

Giving further credence to the analyst’s assertion, Nvidia spotlighted their work with “over 100 customers across cloud, consumer internet, sovereign and vertical industry segments.” Meanwhile, the portion of business coming from Cloud customers declined a bit, demonstrating the growing importance of Enterprise and Consumer Internet management.

In line with his optimism, Ramsay rates NVDA shares as a Buy, while raising his 12-month price target to $1,200 (from $1,100). The new target suggests potential gains of ~16% from current levels. (To watch Ramsay’s track record, click here)

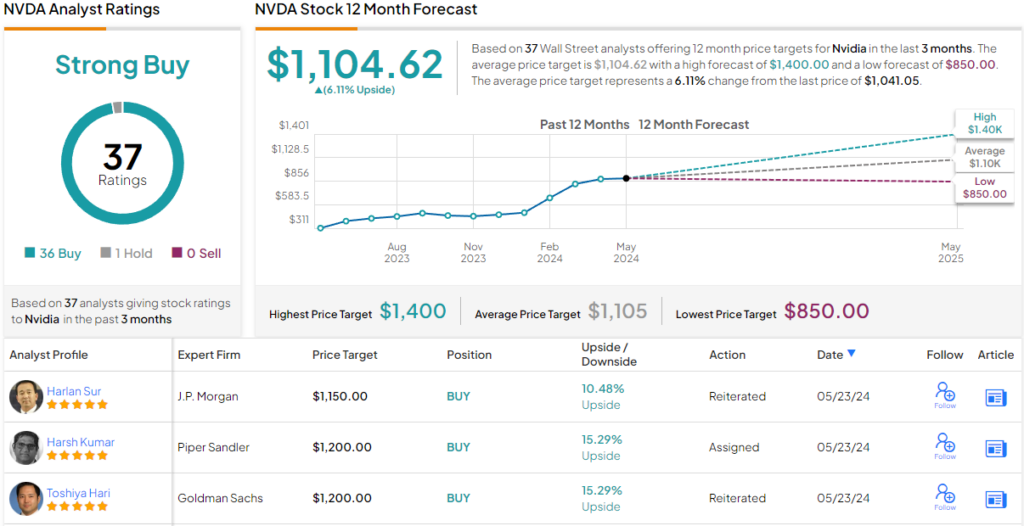

All in all, there is broad optimism on Wall Street. With 36 Buy ratings and just 1 Hold, the message is clear: NVDA is a Strong Buy. The average 12-month price target of $1,104.62 suggests modest gains of ~6% from current levels. (See NVDA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.