The AI race continues to heat up, and with trillions of dollars in potential value at stake, investors are zeroing in on the companies building the backbone of this transformation. Among the leaders are Nvidia (NASDAQ:NVDA) and CoreWeave (NASDAQ:CRWV), two key players supplying the infrastructure powering the AI boom.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Nvidia’s dominance underscores why it sits at the center of this story. The stock has soared more than 1,400% over the past three years, fueled by unmatched demand for its top-tier AI chips and its roughly 90% share of the global data-center GPU market, a position that remains the benchmark competitors must chase.

CoreWeave is a more recent entrant, becoming a public company earlier this year in one of the biggest and most successful IPOs of 2025. CoreWeave rents out Nvidia’s GPUs, supplying hyperscalers with desperately sought-after computing power.

CoreWeave’s revenues have been increasing at a fast clip, surging from $395 million in Q2:24, the last reported quarter, to $1.2 billion in Q2:25. Though it is currently operating at a loss, the company had a revenue backlog of $30.1 billion at the end of Q2:25, pointing to a steady supply of demand going forward.

The stock’s performance reflects that enthusiasm. CRWV has surged nearly 240% from its $40 IPO price, even after a pullback that leaves it roughly 26% below June’s highs.

Though top investor Keithen Drury sees significant potential with both stocks, he believes one has a clear advantage over the other.

“Although both companies have legitimate business models, I prefer Nvidia’s, as it’s supplying the hardware to many clients as opposed to CoreWeave’s smaller customer base,” explains the 5-star investor, who is among the top 3% of stock pros covered by TipRanks.

Still, there are plenty of solid arguments in favor of CoreWeave, acknowledges Drury, notably its superior growth rate. After several quarters with triple-digit revenue growth, the investor points out that Nvidia has “settled” into 50% growth. That’s nothing to be ashamed of, but it is much slower than CoreWeave’s year-over-year revenue increase of 207% in Q2:25.

Profits, however, sit on the other side of the ledger, and here NVDA enjoys a marked advantage. Not only has Nvidia maintained “impressive” net profit margins of at least 50% over the past few years, but CoreWeave’s continuing losses could be a big deal when the company’s hardware units need to be replaced.

“CoreWeave’s operating losses are a huge concern of mine, and start to skew the analysis heavily in favor of Nvidia,” adds Drury.

At the end of the day, Drury concludes that it’s better to be the company that supplies the product, and not the end user. That firmly tips the scales in Nvidia’s favor.

“There are many offerings similar to CoreWeave’s, but there’s only one Nvidia,” Drury summed it up. (To watch Keithen Drury’s track record, click here)

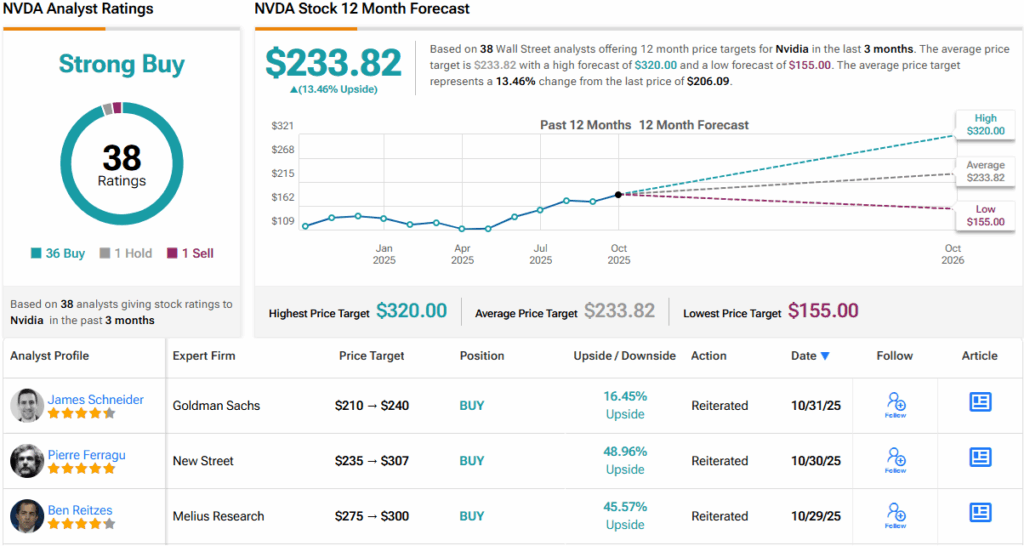

Wall Street is also fully on board the NVDA express. Its 34 Buys, 2 Holds, and 1 Sell give NVDA a Strong Buy consensus rating. Its 12-month average price target of $231.34 implies an upside of ~13%. That may not look explosive at first glance, yet with Nvidia, price targets have a habit of chasing results – and historically, they tend to move higher as the story unfolds. (See NVDA stock forecast)

To find good ideas for AI stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.