Nutanix (NASDAQ:NTNX) buyout is not on Hewlett Packard Enterprise’s (NYSE:HPE) wish list, Dealreporter reported. Earlier, Bloomberg reported that HPE had shown interest in acquiring Nutanix. However, the report also highlighted that these companies are yet to reach an agreement, and talks may not lead to a deal.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Both HPE and NTNX have formed strategic alliances in the past to capitalize on hybrid and multi-cloud adoption. Further, Nutanix’s acquisition would have fortified HPE’s cloud capabilities. Nonetheless, HPE has seen relatively stable demand and delivered strong Q4 financials.

Its focus on strengthening the recurring revenue stream and prioritizing high growth and higher gross margin solutions is paying off and supporting its financials.

Is HPE Stock a Buy?

While management expects demand to remain steady in 2023, macro headwinds, including higher interest rates and inflation, could remain a drag. HPE stock has received four Buy, five Hold, and two Sell recommendations for a Hold consensus rating on TipRanks.

Meanwhile, analysts’ average price target of $16.09 implies a marginal upside potential of 2.42%.

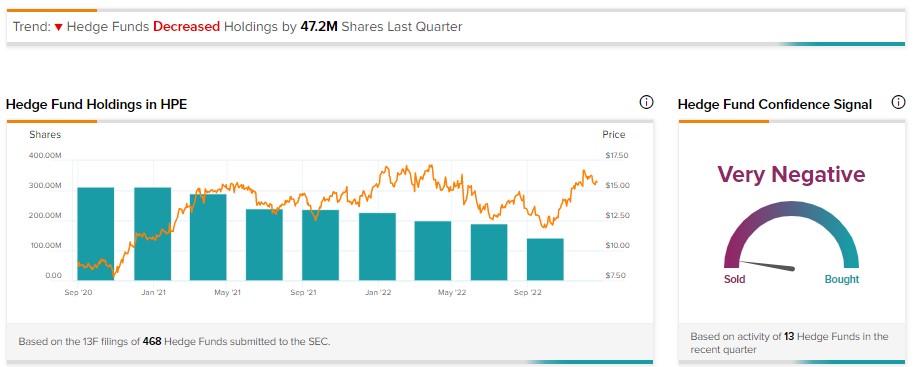

What’s worth mentioning is the significant selling of HPE stocks by hedge fund managers. Our data shows that hedge funds sold 47.2M HPE stock last quarter. Moreover, insiders sold HPE stock worth $602.4K.

Overall, HPE stock carries a Neutral Smart Score of five on TipRanks. (Stay abreast of the best that TipRanks’ Smart Score has to offer.)