The idea of a small-scale nuclear power solution has captured imaginations ever since Doc Brown mounted one to the roof of a DeLorean in the “Back to the Future” series. Mr. Fusion may still be a dream, but NuScale Power (NYSE:SMR) is anything but. However, it’s having its own nightmare right now, down over 11% in Friday afternoon’s trading. The plunge kicked off in earnest yesterday and carried on into today after Iceberg Research, a short-seller, released a report that revealed that NuScale Power currently has two major contracts: one that’s in “peril,” and the other that’s an outright “fake.”

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

This comes after NuScale announced that it had two major contracts for its line of small modular reactor systems: one in Pennsylvania and a second in Ohio. But the problem, Iceberg Research’s report noted, is that the company that contracted NuScale—Standard Power—doesn’t have the means to fulfill a contract as large as the one with NuScale Power. In fact, as it turns out, Standard Power’s managing director was previously found guilty of securities fraud.

However, there’s a second contract that might actually work with Utah Associated Municipal Power Systems. Iceberg called that contract “more credible” but called into question NuScale’s ability to actually fulfill said contract. And, just to top it off, Iceberg notes that NuScale has about 15 months’ worth of cash left to its name, and that might not be enough time to actually turn the company around. Only government support might save NuScale now, Iceberg notes, and such a move would result in “diluted” value for shareholders.

Is NuScale Power a Good Buy?

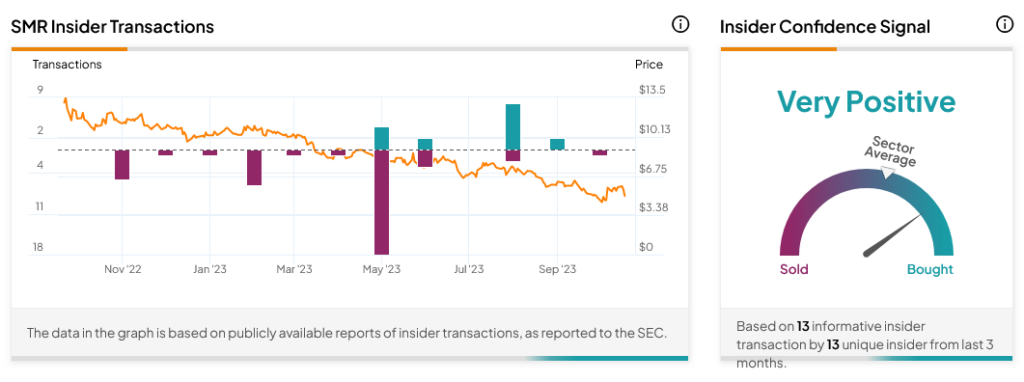

Turning to Wall Street, a look at insider trading within NuScale Power offers a puzzling picture. While insiders are selling off shares at a fever pitch–$258,800 worth in the last three months—the overall insider confidence level is actually “very positive.” Several insiders have purchased shares, but the purchases have been comparatively small against a handful of large-scale sales.