Shares of steel products provider Nucor (NYSE:NUE) are trending lower today after its third-quarter outlook failed to impress investors. The company expects EPS in Q3 to land in the range of $4.10 to $4.20. In comparison, analysts had projected an EPS of $4.46. Additionally, the outlook is also well below the $6.50 EPS figure generated by the company in the year-ago period.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company anticipates that lower pricing and volumes will impact earnings in its steel mills segment in Q3, with a majority of this impact expected at its sheet mills. Additionally, these factors are also expected to affect its steel products segment.

But there’s more, the company expects an impact on earnings in its raw materials segment due to compressed margins at its DRI facilities and scrap processing operations.

Nucor is slated to announce its third-quarter numbers on October 24th.

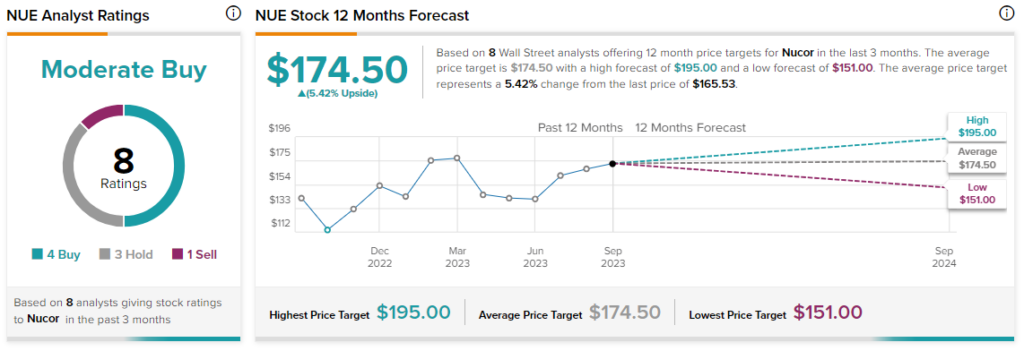

Overall, the Street has a consensus price target of $174.50 on Nucor, alongside a Moderate Buy consensus rating. Shares of the company have gained nearly 37% over the past year.

Read full Disclosure