Shares of steel and steel products producer Nucor (NYSE:NUE) are under pressure today after the company’s financial outlook for the fourth quarter failed to impress investors.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Nucor is experiencing lower pricing and volumes across all of its business segments. The impact of lower pricing is expected to be substantial at its sheet and plate mills. Further, a moderation in average selling prices is expected to result in decreased earnings in the company’s Steel Products segment.

Added to this, a combination of low raw material prices and planned outages at facilities is seen adversely impacting earnings in the company’s Raw Materials segment.

As a result, the company expects EPS for the fourth quarter in the range of $2.75 and $2.85. In comparison, Nucor had posted an EPS of $4.57 in the third quarter. The company is slated to report its fourth-quarter results on January 29. Analysts expect Nucor to deliver an EPS of $3.19 on revenue of $7.49 billion for the quarter. In the comparable year-ago period, Nucor’s EPS of $4.89 had exceeded the Street’s estimates by a wide margin of $0.73.

Is Nucor a Good Stock to Buy?

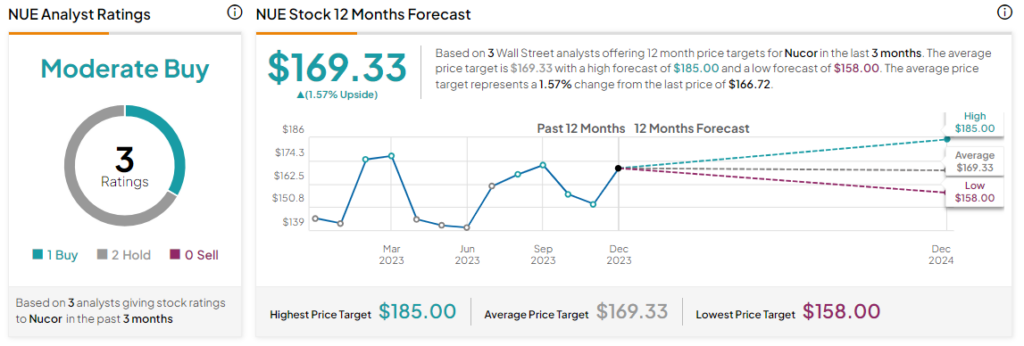

Overall, the Street has a Moderate Buy consensus rating on Nucor. Following a nearly 10% rise in the company’s share price over the past month, the average NUE price target of $169.33 implies the stock may be approaching fair valuation levels.

Read full Disclosure