Novo Nordisk’s (NVO) shares dipped on Tuesday afternoon after the revelation that Helge Lund, the Danish drugmaker’s chair, is resigning from the board following a clash with the company’s majority shareholder.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Six other independent board members will also quit the company’s board at an extraordinary meeting scheduled for November 14, according to multiple media reports. Lund and the Novo Nordisk Foundation — the majority shareholder — had disagreed over the future composition of the drugmaker’s board.

Lund wanted to keep the existing structure while adding new faces with additional competencies. However, the Foundation sought “a more extensive reconfiguration,” the majority shareholder said in a statement.

Board Turmoil Adds Pressure to Novo Nordisk’s Troubles

The tussle over the composition of the company’s board comes at a time when the Danish drugmaker, known for its weight-loss drug Wegovy and Type 2 diabetes medication Ozempic, is battling slower sales growth and profit. This is even as the pharmaceutical company has been losing ground to U.S.-based rival Eli Lilly (LLY) in the obesity market and has turned to job cuts to trim its overhead costs.

Earlier this year, the company appointed insider Mike Doustdar as CEO, following the ousting of Lars Fruergaard Jørgensen as chief executive in May after the company’s shares plunged. Doustdar has assured that he would tighten the Danish pharmaceutical’s focus on commercial performance and on core areas of obesity and diabetes treatments.

Novo Nordisk Foundation Pushes for Support for New CEO

Following up on this, Novo Nordisk Foundation is proposing that Lars Rebien Sørensen — who preceded Jørgensen as Novo Nordisk CEO — should serve as the company’s new chair to support Doustdar in his “transformation plans” to help the company regain its growth momentum.

However, the proposal includes a clause stating that Sørensen will only chair the board for two years and will work to select a new chair to lead the company into the 2030s. The Foundation is also putting forward Cees de Jong as Vice Chair and three other persons as board members.

Is Novo Nordisk a Buy, Sell, or Hold?

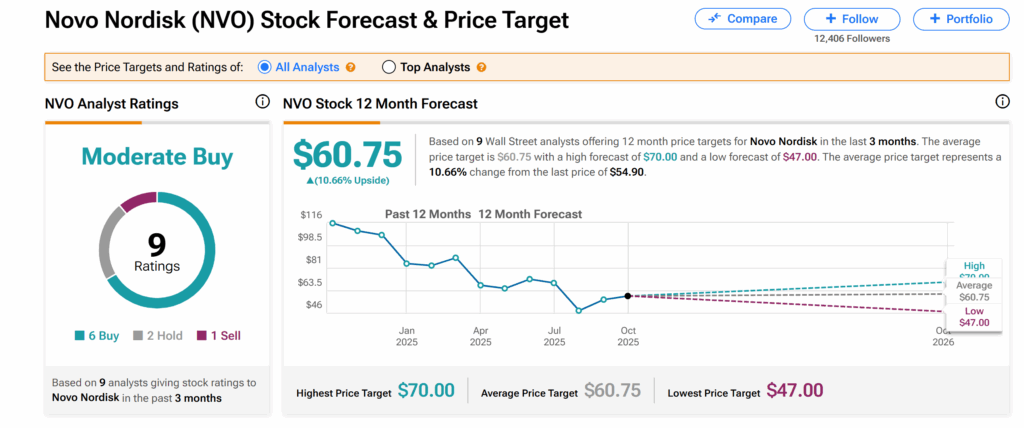

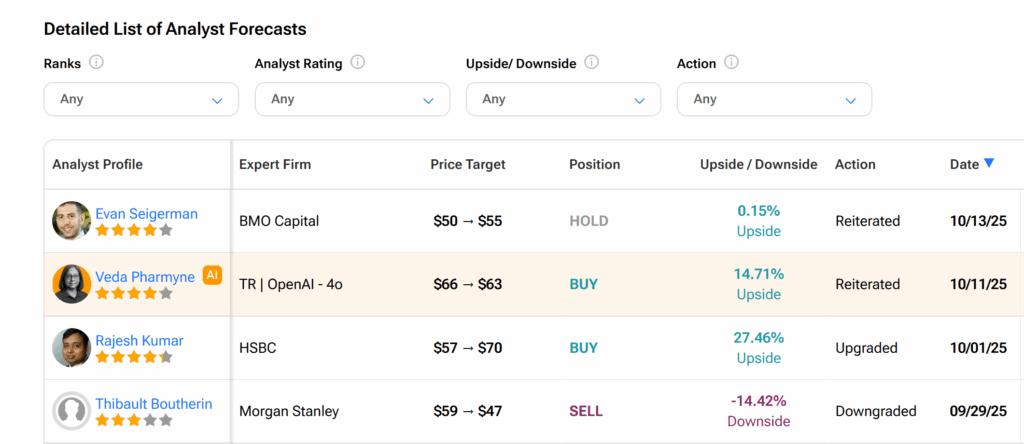

Turning to Wall Street, Novo Nordisk’s shares currently have a Moderate Buy consensus rating, according to TipRanks. This is based on six Buys, two Holds, and one Sell assigned by nine Wall Street analysts over the past three months.

Moreover, at $60.75, the average NVO price target suggests about 11% upswing potential from the current level.