Shares of Novo Nordisk (NVO) fell on Wednesday morning after the Danish drugmaker agreed to a price deal under the U.S. Medicare program for the active ingredients in its blockbuster medications.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The pharmaceutical company also cut its full-year revenue forecast for the fourth time this year. This is even as Novo Nordisk’s third-quarter 2025 earnings results released today showed numbers that missed Wall Street’s projections.

On the other hand, shares of arch-rival Eli Lilly (LLY) continues to enjoy great momemtum following the Danish drugmaker’s earnings miss.

Novo Nordisk’s Deal Is Here — Will Eli Lilly Follow Suit?

According to Reuters, Novo Nordisk’s arrangement relates to semaglutide, the active ingredient in its flagship weight-loss drug Wegovy and diabetes injection Ozempic. The announcement comes as media reports have previously suggested that Novo Nordisk and Eli Lilly are expected to enter a deal with the Trump administration to cut the prices of their obesity drugs, with the lowest dose expected to cost $149 per month.

For Eli Lilly, this price deal is anticipated for its top-selling medications Zepbound and Mounjaro, which are used to manage body weight and diabetes, respectively. These medications come with a list price that tops $1000, although U.S. consumers usually buy them at lower prices, depending on their health insurance plans and the discounts they can get.

Is the Medicare Deal Beneficial for Novo Nordisk?

The deals are expected in exchange for the admission of the drugmaker’s medications into the U.S. government-funded Medicare health insurance program. About 69 million Americans were enrolled in the program as of June 2025, according to the U.S. Centers for Medicare and Medicaid Services.

Pharmaceutical companies fight to get their medications covered by the program to help boost sales. However, analysts are concerned about the impact of the price deal for Novo Nordisk due to the nature of the price cut.

Reacting to earlier news of a potential deal between Novo Nordisk and Eli Lilly, UBS’s (UBS) equity research team noted that the proposed price cut is likely to be met with negative reaction, as it represents a major discount compared with the prices of obesity drugs in markets outside the U.S.

The deal comes at a time when the Danish drugmaker is facing several headwinds as it plans to cut about 9,000 jobs and battles Pfizer (PFE) for control of obesity-focused biotech firm Metsera (MTSR).

Is Novo Nordisk a Buy, Sell, or Hold?

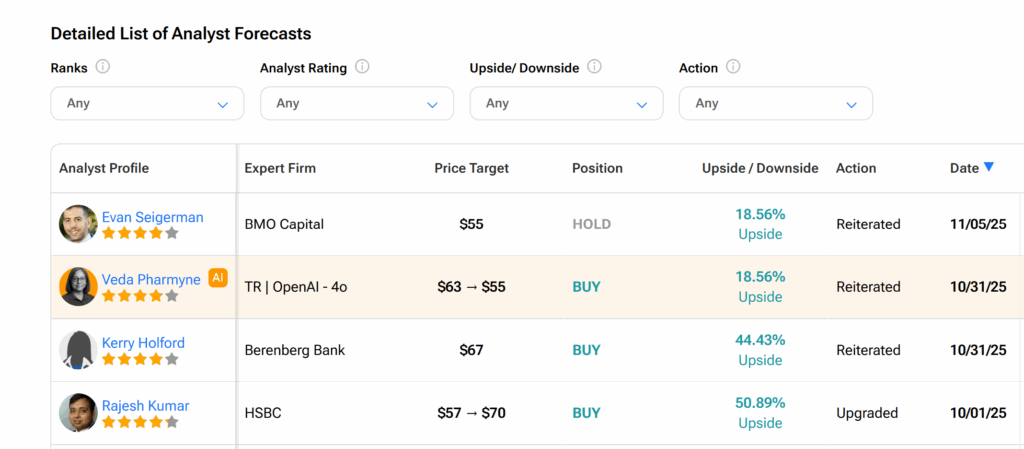

On Wall Street, Novo Nordisk’s shares currently have a Moderate Buy rating, according to TipRanks. This is based on five Buys, two Holds, and one Sell assigned by eight analysts over the past three months.

However, the average NVO price target of $60.50 indicates about a 30% upswing from the current trading level.