Shares of drugmaker Novo Nordisk (NVO) are down at the time of writing following a similar decline the previous day. The losses came after the company’s largest shareholder, the Novo Nordisk Foundation, proposed a major board shake-up. More specifically, the foundation announced that current chair Helge Lund and six other independent board members will step down next month due to disagreements over how quickly the company should change.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In their place, the foundation plans to appoint Lars Rebien Sorensen, Novo’s former CEO and current chair of the foundation, as the new company chair for up to three years. It also nominated six new board members to help lead the company through this transition. Interestingly, analysts at Barclays noted that the timing and scale of the changes were unexpected, especially since Novo had recently appointed a new CEO, Mike Doustdar, in August.

Barclays analysts also described the move as a “structural governance reset,” which suggests that the changes are meant to better align Novo’s leadership with its strategy. This includes focusing more on consumer engagement, expanding in the U.S. market, and exploring potential deals. It is worth noting that Novo’s stock has now lost roughly 45% of its value this year, and investors will be watching closely to see if the new board can guide the company through this period of uncertainty.

Is NVO Stock a Good Buy?

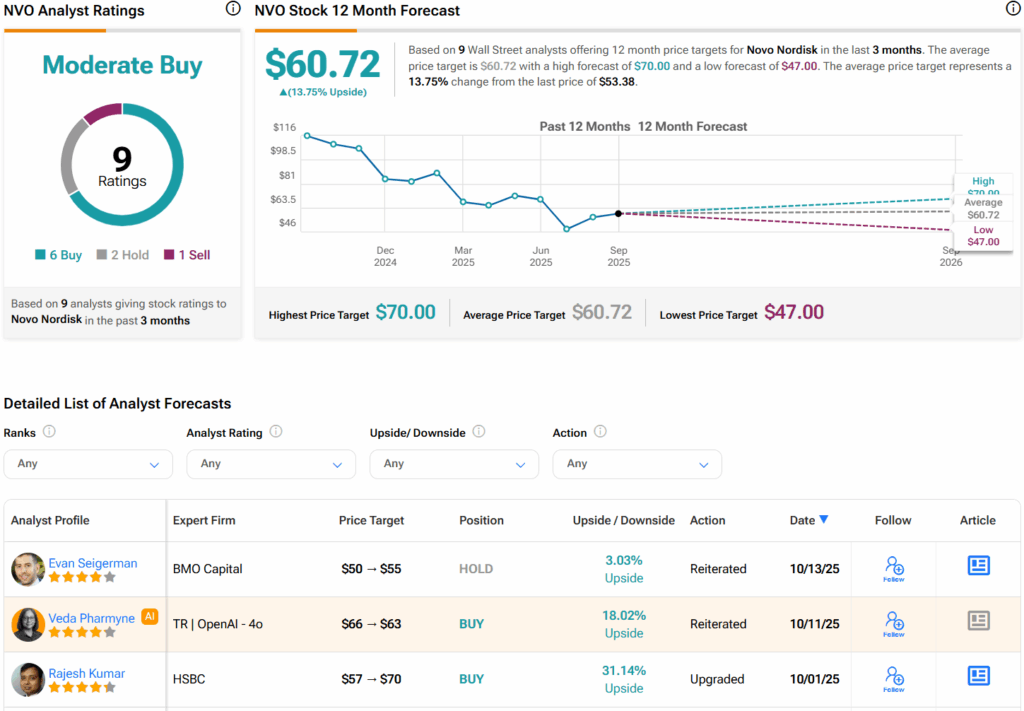

Turning to Wall Street, analysts have a Moderate Buy consensus rating on NVO stock based on six Buys, two Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average NVO price target of $60.72 per share implies 13.75% upside potential.