Healthcare stock Eli Lilly (NYSE:LLY) made headlines when it dropped its prices on insulin, a vital medication needed by diabetics almost everywhere. Now, not to be outdone, Novo Nordisk (NYSE:NVO) is out to do the same by cutting the prices on its line of insulin products by as much as 75%. Investors are modestly happy about such a move, as NVO stock is up slightly in Tuesday afternoon’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

More specifically, Novo Nordisk will cut prices on its NovoLog insulin product by 75% while also cutting prices on Levemir and Novolin, but only by 65%. That’s still good news for anyone buying the stuff on a regular basis. That won’t be the end of it, though; later, Novo Nordisk also plans to cut its non-branded lines to bring them in line with other brands. Thanks to the changes, customers will pay $72.34 for a vial of NovoLog and $139.71 for a set of injection pens.

The move comes at a welcome time; as inflation runs roughshod over consumers of pretty much everything, insulin prices have more than tripled in just the last 20 years. Not surprisingly, patients find themselves in bad positions, and drugmakers find themselves called upon to help. No one wants to be on the bad end of a Congressional investigation featuring old folks choosing between medicine and, say, food and rent. So proactively cutting drug prices is likely to insulate drug makers from the worst of populist sentiment.

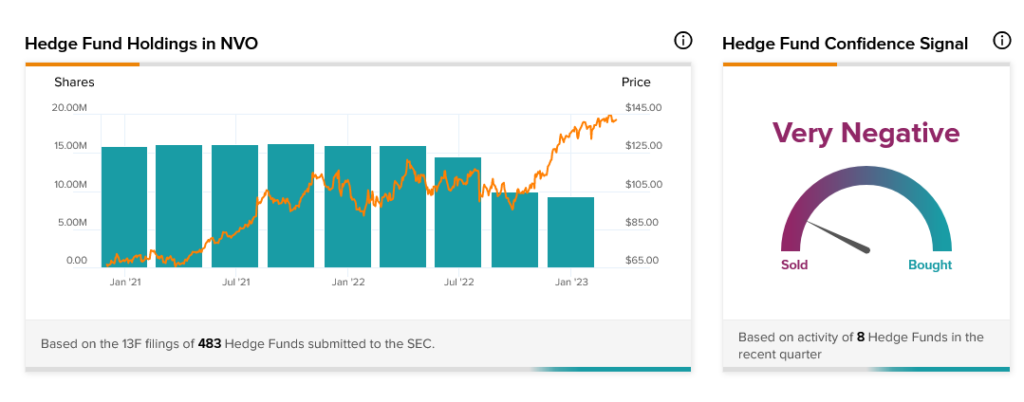

This move, no matter what its impact on sentiment, didn’t come fast enough for hedge funds, as their confidence is currently classed as Very Negative. Worse, they have been actively paring back their stakes in Novo Nordisk. This is the third consecutive quarter that hedge funds have decreased holdings, selling off 684,000 shares last quarter.