The pandemic thrust biotech company Novavax (NASDAQ:NVAX) into the limelight, attracting investors and driving its share price past $300 at one point. However, the post-pandemic era has been less kind. With diminishing fears of the virus, the company has seen a significant decline in market relevance. While the stock looks like a relative value trade, high volatility and the challenges of navigating the rapidly evolving biotech market landscape make this a highly speculative investment option.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Story So Far

Novavax is a biotechnology company that discovers, develops, and commercializes recombinant vaccines to prevent infectious diseases. Primarily known for its COVID-19 vaccine NVX-CoV2373, the company is developing a combination flu and COVID-19 vaccine and a Malaria vaccine.

The company gained popularity during the COVID-19 pandemic and was a key player, along with Pfizer (NYSE:PFE)/ BioNTech (NASDAQ:BNTX) and Moderna (NASDAQ:MRNA), in the race to develop a vaccination. Investors flocked to it, driving the share price up over $300 at one point.

Since then, Novavax has suffered a significant downturn in its market relevance as fears of the virus decreased, leading to a 97.68% drop in share value over the past three years. In early 2023, the company was forced to issue a going concern warning, expressing “substantial doubt” over its continued operation. Novavax implemented a restructuring plan that resulted in a 30% reduction of its workforce over the past year.

Recent Results

Novavax ended the fourth quarter of 2023 reporting a loss of $1.44 per share, widely missing the expectation for a loss of $0.45 a share. The company also reported an 18% year-over-year decrease in revenue to $291.3 million, falling short of the consensus estimate of $322.1 million.

The company also reached a settlement agreement with Gavi, the global vaccine alliance, resolving a dispute regarding the termination of an earlier advance purchase agreement Gavi had with Novavax for its COVID-19 vaccine, which was a dark cloud hanging over the company.

Management has given 2024 revenue guidance of $800 million to $1 billion, roughly in line with the consensus estimate of $969.56 million.

Where NVAX Stock Stands Now

NVAX stock has been highly volatile, climbing 22% after the settlement with Gavi and plunging 25% after the Q4 earnings release days later. The last closing price of $5.14 is trading toward the low end of the stock’s 52-week range of $3.53-$11.36.

Based on comparative valuation metrics, the stock is relatively undervalued. The P/S (price-to-sales) ratio of 0.8x is below the Healthcare sector (1.97x) and Biotechnology industry (10.04x) averages. However, apart from a brief spike in valuation during the pandemic, the company has consistently traded in a value range, reflecting ongoing negative issues with the company that the market continues to price in.

Short interest on the stock is relatively high at close to 40% of shares outstanding. This could create the potential for any good news to unleash a short squeeze, driving the shares higher, as short sellers are forced to buy to replace borrowed stock, increasing demand and forcing prices up.

What is NVAX Price Target?

Analysts covering Novavax stock have taken a neutral-to-cautious view of it. For instance, TD Cowen analyst Brendan Smith recently maintained a Hold rating on Novavax’s stock, setting a price target of $5. He cited recent performance and future revenue concerns.

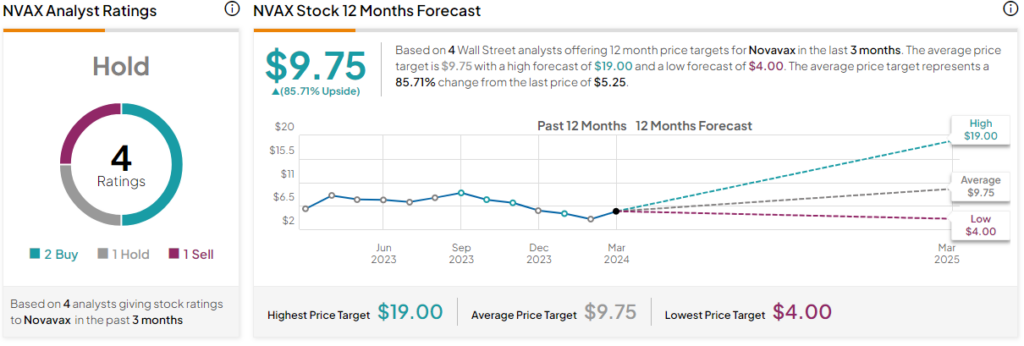

Overall, Novavax is listed as a Hold based on four analysts’ stock ratings in the past three months. The average NVAX stock price target of $9.75 represents an upside potential of 85.71% from current levels.

Closing Thoughts on NVAX

Novavax’s performance over the past few years has painted a portrait of a company grappling with challenging times. Harsh fallout from the receding COVID-19 pandemic and a downturn in market relevance has seen the firm’s shares take significant hits. The recent Q4 disappointment and staff downsizing serve as testaments to the predicaments facing the firm.

That said, there’s a glimmer of hope, given the recent settlement with Gavi and opportunities for pipeline vaccines. NVAX stock trades at a value, so there’s potential for patient investors to see gains, but it’s a highly speculative outcome at this juncture.