Swiss drugmaker Novartis AG (NYSE:NVS) has entered into a $3.5 billion deal to acquire Chinook Therapeutics in order to expand its portfolio of treatments for rare diseases. The companies are expected to close the deal in the second half of 2023.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

As per the agreement terms, Novartis will pay $40 per share in cash to Chinook’s shareholders. Additionally, NVS will pay another $4 per share upon the achievement of certain regulatory milestones.

The milestones mentioned are tied to the progress of Chinook’s two late-stage medicines designed to address a rare chronic kidney disease known as IgA nephropathy, or IgAN. Notably, one of these treatments is already in Phase 3 development, while the other is about to enter Phase 3. It is noteworthy that both medications are included in the acquisition agreement.

The anticipated positive key results from the trials of these two treatments hold the potential to significantly enhance NVS’ prospects. This is particularly noteworthy due to the limited treatment options available for IgAN in the market. Furthermore, rare disease treatments often command higher prices, indicating a favorable outlook for Novartis’ bottom-line growth.

Is NVS Stock a Good Buy?

Overall, Wall Street is cautiously optimistic about NVS stock, with a Moderate Buy consensus rating based on two Buys and one Hold. The average price target of $118.50 suggests 17.4% upside potential from the current levels. Shares have gained nearly 13% year-to-date.

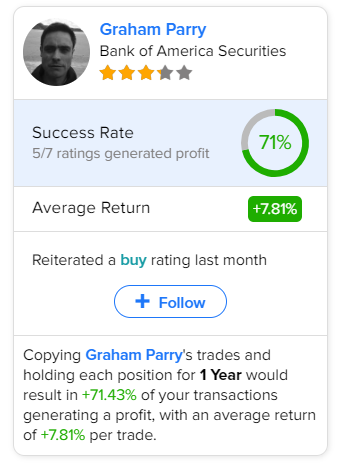

Investors looking for the most accurate and profitable analyst for NVS could follow Bank of America Securities analyst Graham Parry. Copying the analyst’s trades on this stock and holding each position for one year could result in 71% of your transactions generating a profit, with an average return of 9.01% per trade.