Novartis (NYSE:NVS) has reportedly agreed to pay $245 million to resolve a class-action litigation. This lawsuit accused the Swiss drugmaker of trying to delay the launch of its low-cost hypertension drug in the U.S.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The litigation had begun in 2018, with CVS Health (CVS), Kroger (KR), Rite Aid (RAD), and Walgreens Boots Alliance (WBA) as plaintiffs.

A licensing agreement signed between Novartis and Par Pharmaceutical back in 2011 was the reason behind this litigation. Both companies have been accused of entering an illegal “reverse payment” agreement in order to intentionally delay the introduction of Exforge.

Moreover, the plaintiffs said that Novartis and Par avoided competing with each other. On this front, Novartis allowed Par a 180-day exclusivity period by not launching its Exforge generic in the market. Similarly, Par agreed not to launch its generic drug for about two years after one of Novartis’ patents expired.

Parting Thoughts

Novartis’ emphasis on streamlining its operations, along with plans to expand its presence in Germany and the U.S., bode well for long-term growth. Also, positive progress in securing regulatory approvals and encouraging trial results might keep supporting the company’s performance.

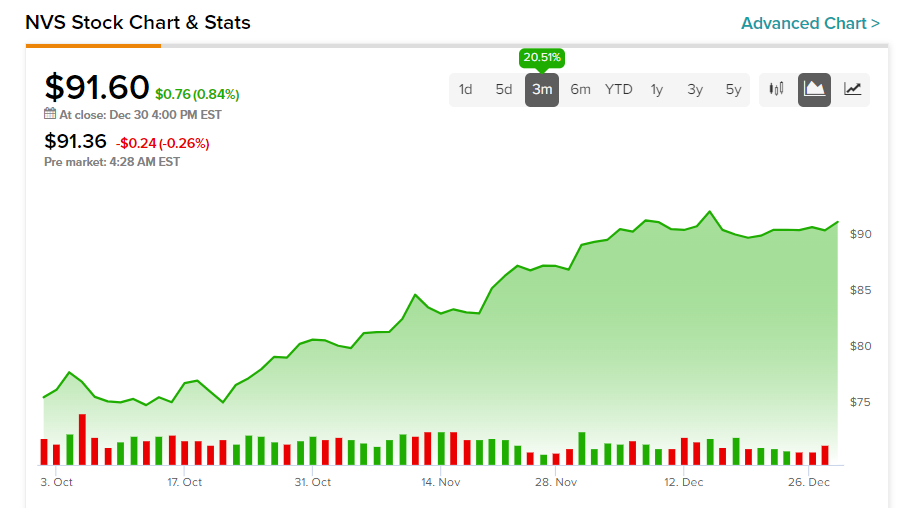

Furthermore, the stock seems to be undervalued. NVS stock has a P/E ratio of 9.3x at present, reflecting a 62.4% discount from the sector’s median of 24.9. Shares of Novartis have gained more than 20% over the past three months.

Special end-of-year offer: Access TipRanks Premium tools for an all-time low price! Click to learn more.