Intel (NASDAQ:INTC) has had an incredible month, to say the least.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company’s recent partnership with Nvidia, the most valuable publicly-traded company in the world, proved to be quite the shot in the arm for the beleaguered Silicon Valley pioneer.

Indeed, the market’s passion was fully aflame in the days following the surprising announcement, in which the one-time rivals declared their intention to partner on building AI datacenters and PCs. This comes in addition to a $5 billion investment that Nvidia is making in Intel.

Intel’s share price has been flying upwards, gaining close to 40% over the past week and change. That includes a bit of a stumble yesterday, during which INTC sank by close to 3%.

Top investor Daniel Sparks doesn’t think this dip is worth getting excited over.

“After a strong multiweek run on policy support and partner headlines, some cooling off looks normal,” explains the 5-star investor, who is among the very top 1% of stock pros covered by TipRanks.

Sparks notes that the recent drop didn’t come about due to anything that occurred directly at Intel, but was rather driven by a new price target from Deutsche Bank and some good old-fashioned profit-taking.

In fact, the investor isn’t surprised at all by the falling share price, as this type of “giveback day” after a sharp surge is often par for the course.

Instead of fretting over these minor dips, investors should be keeping their eyes on the long-term game. As Sparks details, the eventual success for Intel “still hinges on product road-map progress and the foundry strategy delivering competitive performance and better economics.”

The share price, once down in the dumps, is no longer quite as cheap, adds Sparks. In fact, its Price-to-Sales ratio is now approaching 3x, a jump from its previous multiple of 1.8x a year ago.

While he is not ready to term INTC overvalued at this stage, Sparks is also happy to take a wait-and-see approach.

“With the stock up meaningfully in recent weeks, patience — or at least a tighter margin of safety — appears reasonable for investors weighing new positions,” sums up Sparks. (To watch Daniel Sparks’ track record, click here)

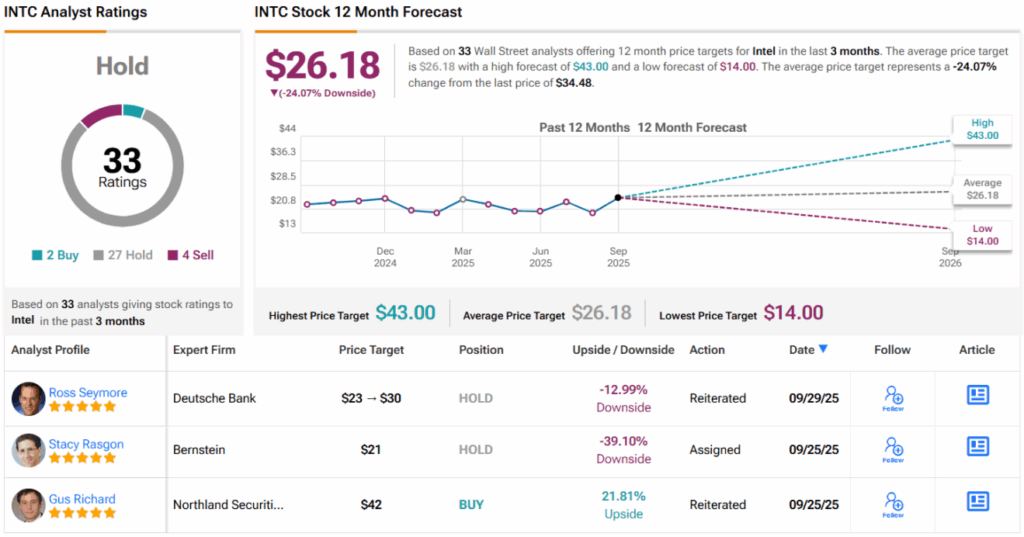

Wall Street, for its part, appears content to wait around. With 27 Hold ratings far outpacing 2 Buys and 4 Sells, INTC carries a consensus Hold (i.e. Neutral) rating. Its 12-month average price target of $26.18 would translate into losses of ~24%. (See INTC stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.