Who wouldn’t want to get in on the ground floor of a wild success story? Priced cheaply, with rapid gains north of 70% in 2025, and competing in the lucrative field of AI-supported decision making, it is understandable that some would consider BigBear AI (NYSE:BBAI) the next big thing.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In fact, many observers have drawn a line between BigBear AI and Palantir (NASDAQ:PLTR), one of the market’s flashiest success stories in recent years. Both companies are betting on AI-powered tools to boost operational efficiency, while pursuing lucrative contracts with the U.S. defense sector. (In fact, BBAI brands itself as “mission-ready AI for defense and national security.”)

So, should investors jump on the BBAI train before it explodes into the stratosphere like the high-flying Palantir? Top investor Adam Spatacco isn’t so sure that’s the right approach.

“Palantir’s deepening role in the defense landscape could suggest that it is building a durable structural moat — one that BigBear.ai is unlikely to penetrate,” explains the 5-star investor, who is among the top 2% of stock pros covered by TipRanks.

Spatacco points out that Palantir is winning huge multiyear contracts with the U.S. army, NATO, and other agencies in the U.S. government. He notes that BigBear, in contrast, has been “relegated to modest, niche opportunities.”

The investor addresses the price disparity between the two firms directly, readily acknowledging that Palantir’s Price-to-Sales multiple of 124.98x is vastly higher than BBAI’s ratio of 10.24x. That doesn’t automatically mean that investors should be seduced by BBAI’s cheaper price, however.

“BigBear.ai’s discounted valuation relative to Palantir isn’t a sign of hidden value. Instead, it’s a reflection of the company’s weak competitive realities,” adds Spatacco.

Further adding holes to the BBAI bull argument, the investor compares the revenue trends of the two companies. Whereas Palantir has continued on its upward trajectory with nary a dip in sight, BBAI has been swinging up and down over the past few years.

Not only that, but Palantir’s revenues over the past twelve months of $3.441 billion make BBAI’s $152.6 million in sales over the same period look quite small indeed. Likening BBAI to its much larger rival just doesn’t make sense, sums up the investor.

“Its compressed multiple is less a sign of mispriced value and more a reflection of persistent operational headwinds in the shadow of Palantir’s dominance,” emphasizes Spatacco. (To watch Adam Spatacco’s track record, click here)

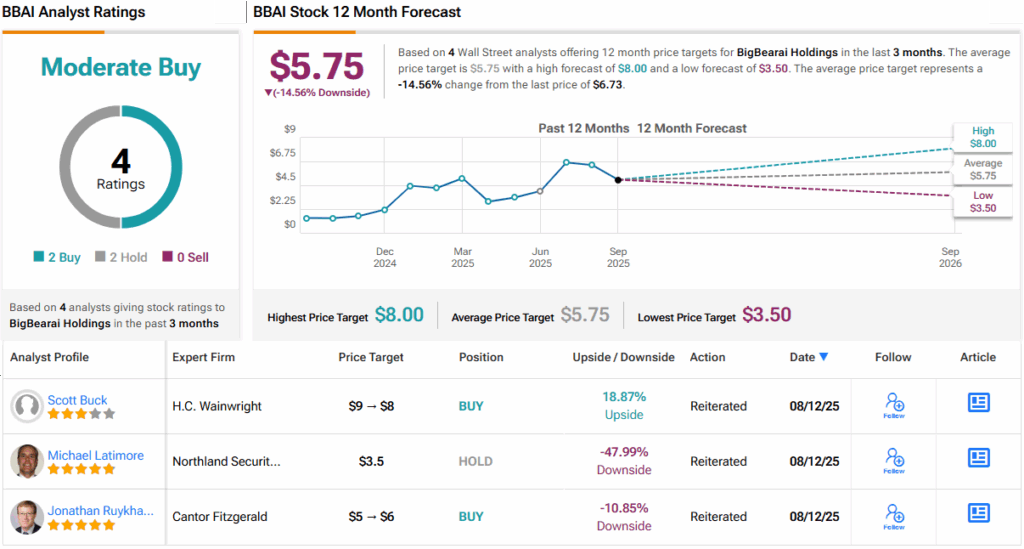

BBAI remains largely under the radar on Wall Street. The stock has only drawn 3 ratings so far – 2 Buys and 1 Hold – which translates into a Moderate Buy consensus. Even so, the 12-month average price target of $5.75 suggests ~15% downside from current levels. (See BBAI stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.