Northwest Healthcare Properties Real Estate Investment Trust (TSE:NWH.UN), a healthcare REIT operating in multiple countries, unveiled a series of initiatives aimed at boosting its financial position. Key moves include extending its credit facility’s maturity date, the sale of assets, and a large 55% dividend cut.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

To fortify its balance sheet, Northwest has secured a one-year extension on its US$127.5 million credit facility (translating to around C$172 million), pushing the maturity date to January 2025. Also, the REIT has garnered about C$82 million from Australian Unity Healthcare Property Trust (AUHPT) unit sales, primarily to repay debt. By early 2024, Northwest anticipates generating net proceeds of approximately C$110 to C$120 million from its AUHPT holdings

Moreover, the REIT has pinpointed non-core asset disposals as a focal strategy. Asset sales have accumulated roughly C$74 million so far this year, with an anticipated C$50 million more by the end of the year. It will even try to sell an additional ~C$100 million worth of additional assets, which are “currently under conditional agreement or are being marketed for sale,” according to the firm. Northwest plans to use these proceeds to offset debt and for general trust purposes.

Notably, Northwest slashed its dividend by 55%, as mentioned above. It slashed the monthly payout from C$0.06667 to C$0.03 per unit, or C$0.36 per unit on an annualized basis. This will bring its annual dividend yield down to 5.9% at current prices from a prior 13%.

A key reason for this move was the maturing of current interest rate caps in Q1 2024, predicted to reduce the REIT’s AFFO per unit by an estimated C$0.16 to C$0.20 annually. This adjustment is expected to enhance the REIT’s financial flexibility.

Lastly, a strategic review is underway, with the engagement of Canadian banks, Scotiabank and RBC Capital Markets, and international bank Deutsche Bank Securities for advisory roles. The review’s primary focus is on potential asset sales, particularly in the U.S. and Brazil.

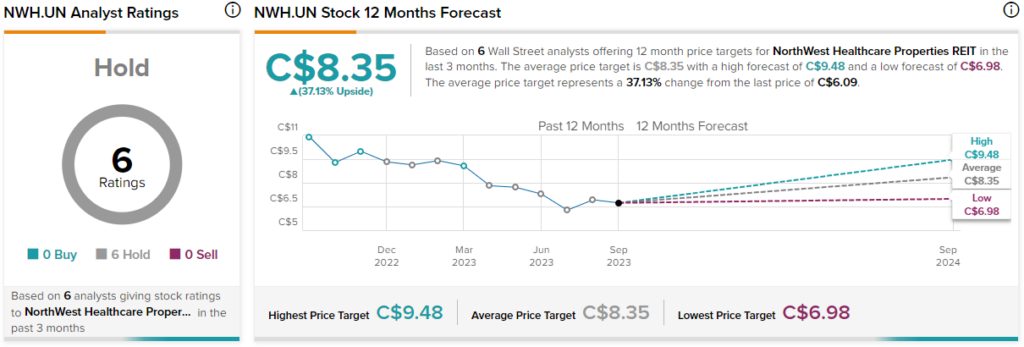

Is NWH.UN Stock a Buy, According to Analysts?

According to analysts, NWH.UN stock comes in as a Hold based on six unanimous Hold ratings assigned in the past three months. The average NWH.UN stock price target of C$8.35 implies 37.1% upside potential.