Northland Power (TSE:NPI), a Canadian renewable energy producer, has achieved a significant milestone in its Baltic Power offshore wind project by securing C$5.2 billion in “non-recourse green financing,” aiding the project’s development over a 20-year term.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The venture, in collaboration with Orlen S.A., comes with a hefty price tag of approximately C$6.5 billion and is financially supported by a unique 25-year agreement with the Government of Poland, referred to as a Contract for Difference (CFD). This arrangement ensures that Baltic Power will be paid a fixed rate for the energy it generates, which is “Euro-pegged and inflation-indexed,” providing financial stability and protection against inflation.

Northland emphasized the project’s potential to generate considerable cash flow and adjusted EBITDA. Once it’s up and running, Northland’s Baltic Power interest is anticipated to produce a “five-year average Adjusted EBITDA of approximately [C]$300 to [C]$320 million and [C]$95 to [C]$105 million of Free Cash Flow per year.” The secured funding covers 80% of the total capital cost, with project partners contributing the remainder.

With all the essential environmental approvals and primary construction contracts in place, the project is on track to commence full operations by the second half of 2026. Nevertheless, the stock is down modestly on the news.

Is NPI Stock a Buy, According to Analysts?

According to analysts, NPI stock comes in as a Strong Buy based on nine unanimous Buy ratings assigned in the past three months. The average NPI stock price target of C$34.54 implies 48.1% upside potential.

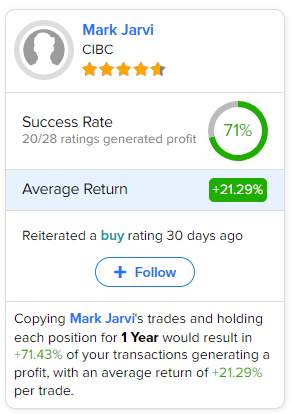

If you’re wondering which analyst you should follow if you want to buy and sell NPI stock, the most accurate analyst covering the stock (on a one-year timeframe) is Mark Jarvi of CIBC, with an average return of 21.29% per rating and a 71% success rate. Click on the image below to learn more.