After market close today, Canadian retailer The North West Company (TSE:NWC) released its Fiscal Q2-2023 earnings results. Both earnings per share (EPS) and revenues beat analysts’ estimates.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The North West Company’s revenue of C$618.1 million grew 6.8% year-over-year, beating the consensus estimate of about C$607.6 million. Further, NWC’s adjusted earnings per share reached C$0.80, higher than last year’s figure of C$0.67 (around 19.4% growth) and the C$0.66 consensus estimate. Similarly, North West’s adjusted EBITDA increased by 14.7% to C$83.3 million.

Also, NWC’s gross profit margin expanded by 128 basis points due to a favorable change in product mix and “a higher pass through of cost inflation in retail prices,” according to the company, which explains the solid earnings results.

Is NWC a Good Stock to Buy?

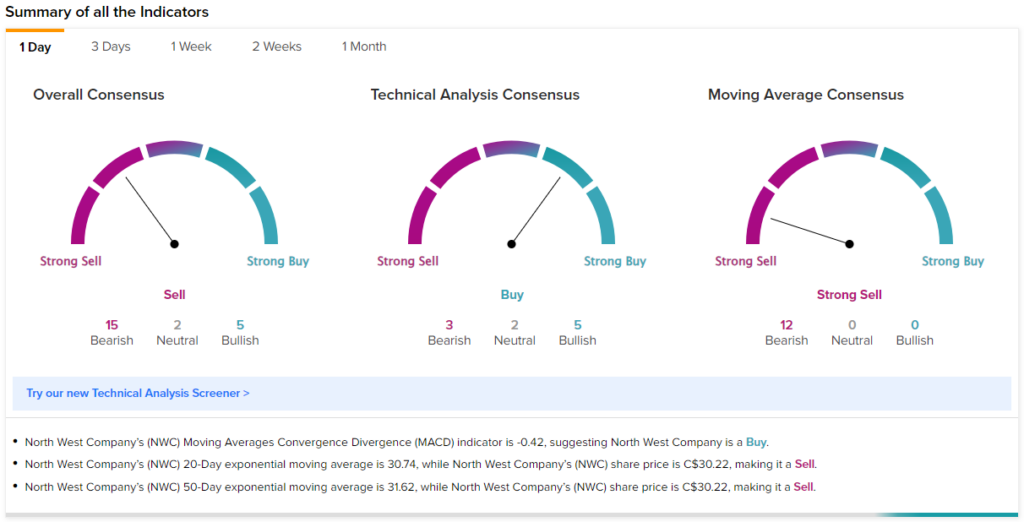

NWC stock has taken a beating recently, falling from nearly C$40 in April to its current price of C$30.22, which may have investors wondering whether it’s a Buy or Sell. According to TipRanks’ technical analysis indicators, the stock has a Sell rating overall when looking at the one-day time frame, as shown below.

However, while there have been no analyst ratings on the stock in the past three months, the two most recent ratings that came after NWC’s Q1 earnings report imply upside potential of 19.1% and 29%, respectively. These analysts are likely to give the stock updated ratings soon now that Q2 earnings have been released, so make sure to follow NWC’s analyst forecasts here.