Nordstrom (NYSE: JWN) fell 4.4% yesterday despite the retailer’s better-than-expected results for the second quarter. This drop in stock price can be attributed to year-over-year lower sales, which remained below pre-pandemic levels. Following its earnings release, two of the analysts assigned a Hold rating to the stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In terms of outlook, Nordstrom reaffirmed its full-year guidance and expects revenue to decline in the range of 4% to 6%. Adjusted EPS is projected between $1.80 and $2.20.

Q2 Results in Brief

JWN posted Q2 earnings of $0.84 a share, much greater than the Street’s estimate of $0.45. Also, it compared favorably with earnings of $0.81 reported in the previous year’s quarter. Meanwhile, revenues decreased 8.3% year-over-year to $3.77 billion, surpassing analysts’ estimates of $3.68 billion.

Furthermore, sales at Nordstrom’s namesake stores declined 10.1%, while sales under the Nordstrom Rank banner fell 4.1%. At the same time, digital sales decreased 12.9% compared with the same period in Fiscal 2022.

In terms of the other key metric, gross merchandise value (GMV) decreased 8.5% year-over-year in the second quarter. On the brighter side, JWN was able to reduce inventory by 17.5%, which points to strong discipline in the company’s operations.

The company’s performance in the reported quarter was impacted by macro challenges affecting consumer spending and its decision to wind down Canadian operations.

Analysts’ Views

Among the neutral analysts, Robert Drbul from Guggenheim is of the opinion that Nordstrom is actively making efforts to meet changing consumer trends in areas such as digital and omnichannel.

Drbul, however, expects macroeconomic uncertainty and a slowdown in sales to persist in 2H23. Also, the analyst is looking for “some sustainability in the company’s operational performance.”

Another analyst with similar sentiment is Brooke Roach from Goldman Sachs. Roach is optimistic about the company’s “strategic priorities, including inventory control, better-branded merchandise at the Rack, and advancing supply chain initiatives.”

Nevertheless, the analyst remained concerned about the management’s cautious tone on third-quarter sales and a “still-soft Designer business.”

Is Nordstrom a Buy or a Sell?

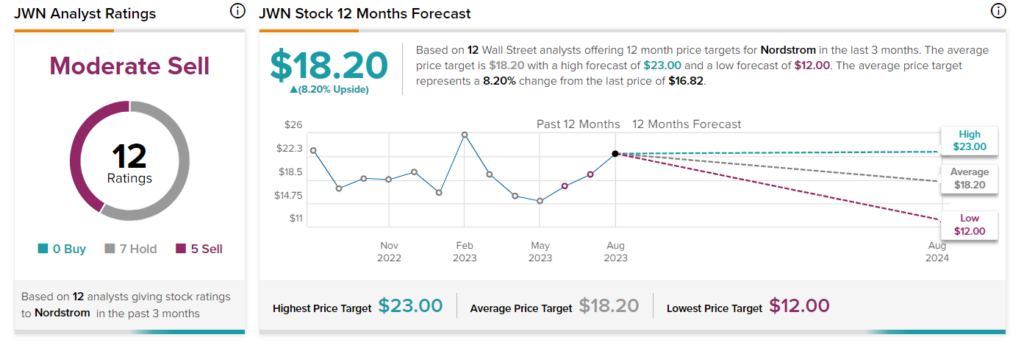

Overall, JWN stock has a Moderate Sell consensus rating based on seven Holds and five Sells. The average price target of $18.20 implies 8.2% upside potential from the current level. The stock is up 9.2% so far in 2023.