While retailer Nordstrom (NYSE:JWN) has faced many of the troubles that mall-facing retail chains have faced throughout the sector, it’s gamely soldiered on and produced results. Now, Nordstrom shares are surging, up nearly 11% in Tuesday afternoon’s trading, thanks to reports that it may be going private.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Reports note that Nordstrom has pulled in Centerview Partners and Morgan Stanley (NYSE:MS) to see if there are private equity firms interested in picking up the retailer. This isn’t the first time that Nordstrom has tried to go private; a similar deal back in 2018 ultimately failed to go through.

However, Nordstrom isn’t exactly bargaining from a position of strength right now; ongoing macroeconomic headwinds have left Nordstrom—and other retailers—on the back foot. Worse, Nordstrom’s recent 2024 outlook proved to be less than the company—or its investors—wanted to see.

Working on Improving Customer Experience

It is possible, meanwhile, that Nordstrom may not find a buyer and may instead have to go to war with the hand it’s dealt. That makes its other plans good news; it’s working on improving its customer experience and rebuilding its key brand. The Nordstrom Rack banner has gotten a fresh redesign, complete with a new, trendier look.

Reports note that Nordstrom will target a depressed consumer market by focusing on “minimalist pieces” and “tailored classics,” a combination that may be effective as consumers watch their pennies.

Is Nordstrom a Good Stock to Buy Now?

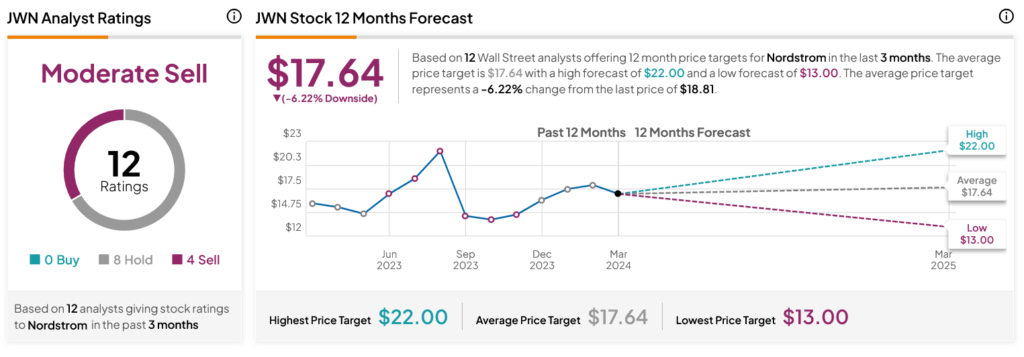

Turning to Wall Street, analysts have a Moderate Sell consensus rating on JWN stock based on eight Holds and four Sells assigned in the past three months, as indicated by the graphic below. After a 22.82% rally in its share price over the past year, the average JWN price target of $17.64 per share implies 6.22% downside risk.