Nordstrom (NYSE:JWN) kept analysts on the sidelines following its third-quarter results, as four of them assigned a Hold rating to the stock. JWN stock declined about 5% yesterday as the company’s disappointing Fiscal Year 2023 outlook hurt investors’ sentiment.

Among the neutral analysts, Piper Sandler analyst Edward Yruma noted that the company’s inventory levels remain under control and that JWN is well-positioned to benefit from an improving macro environment. However, he maintains a Hold due to lingering uncertainties surrounding the spending power of premium consumers.

Another top-rated Guggenheim analyst, Robert Drbul, has maintained a Hold rating on JWN stock. Drbul remains cautious about a slowdown in sales trends. The analyst awaits signs of stability and enhancement in the Rack’s business before considering an upgrade for the stock.

Is Nordstrom a Buy or Sell?

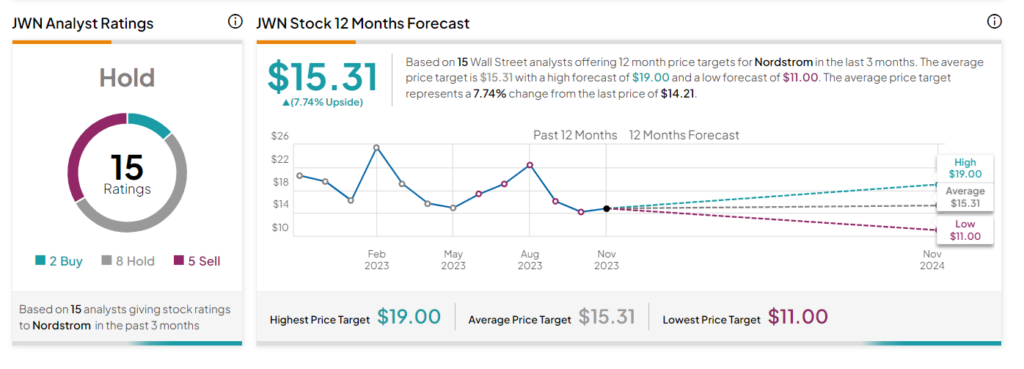

Overall, the Street has a Hold consensus rating on Nordstrom stock. This is based on two Buys, eight Holds, and five Sells ratings in the past three months. The average JWN price target of $15.31 points to a 7.7% potential upside in the stock.