Nordson (NASDAQ:NDSN) reported impressive results for the fourth quarter of Fiscal Year 2023, as both earnings and revenue exceeded estimates. The company’s performance was supported by strong demand for packaging, industrial coating, and strength in polymer processing product lines. NDSN manufactures dispensing equipment for consumer and industrial adhesives, sealants, and coatings.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Following the earnings release, a Top-rated Keybanc analyst Jeffrey Hammond reiterated a Buy rating on NDSN stock. Interestingly, TipRanks allows one to explore and analyze the performance of Top Wall Street Analysts, making it easier for investors to make informed decisions based on the track records of these experts.

Q4 Earnings Snapshot

Q4 revenues of $719.3 million increased 5% year-over-year and came above the Street’s estimate of $638.7 million. The top line benefitted from a favorable acquisition impact of 7% and a currency translation of 1%, partially offset by an organic volume decrease of 3%.

Meanwhile, the company posted adjusted earnings of $2.46 per share, higher than the Street’s estimate of $2.40 per share. Also, the reported figure compares favorably with $2.44 in the prior year’s quarter.

Looking forward, the company said it entered Fiscal 2024 with a strong order backlog of about $800 million. Nordson expects Fiscal 2024 revenue to increase by 4% to 9% year-over-year. Furthermore, full-year adjusted earnings are expected to grow in the range of 1% to 8% per share. For the fiscal first quarter, NDSN forecasts sales in the range of $615 to $640 million, with adjusted earnings between $2 to $2.10 per share.

Is NDSN Stock a Good Buy?

Nordson has a well-diversified business that supports organic growth. Also, it has been making strategic acquisitions to fuel growth. In addition to this, NDSN has an impressive dividend history, increasing its payout every year since 2010. These factors make the stock an attractive investment for long-term investors.

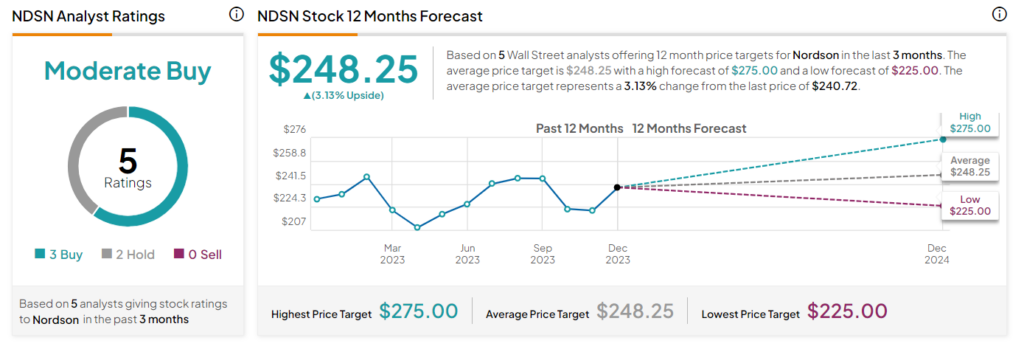

Overall, Wall Street analysts are cautiously optimistic about Nordson stock and have a Moderate Buy consensus rating. This is based on three Buys and two Holds. The average NDSN stock price target of $248.25 implies 3.13% upside potential.