Nordson (NASDAQ:NDSN) reported disappointing results for the first quarter of the Fiscal Year 2023 and cut its full-year outlook. The company manufactures dispensing equipment for consumer and industrial adhesives, sealants, and coatings.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The overall quarterly performance of Nordson was impacted by unfavorable currency headwinds, the timing of the Chinese New Year, and the negative impact of the spread of COVID-19 in China.

Nordson posted Q1 revenues of $610.5 million, up slightly year-over-year but missed the Street’s estimate of $623.9 million. The top line benefitted from 1% organic volume growth and a favorable acquisition impact, partially offset by currency exchange headwinds.

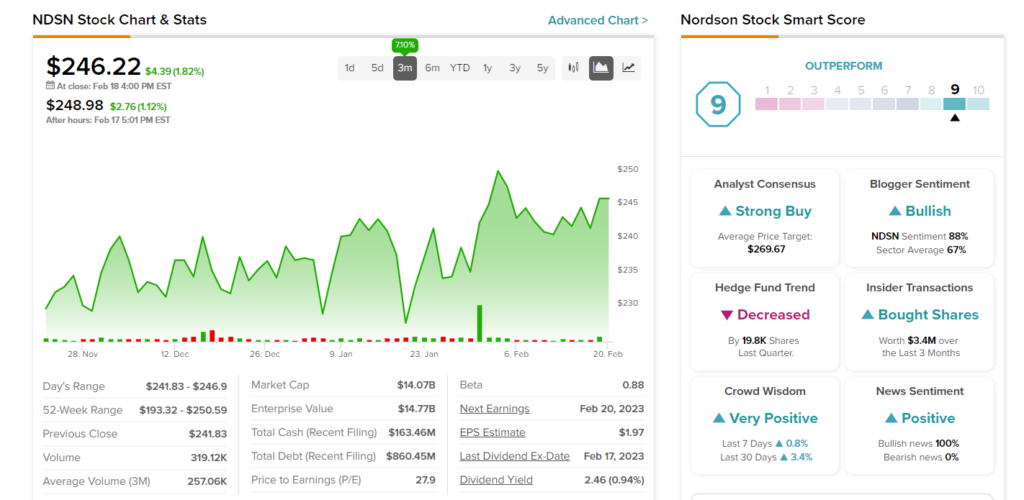

Meanwhile, the company posted adjusted earnings of $1.95 per share, lower than the Street’s estimate of $1.97 per share. The reported figure compares unfavorably with $2.07 in the prior year’s quarter.

Fiscal 2023 Outlook

Looking forward, Nordson trimmed its Fiscal 2023 guidance as it noted that the order backlog is heavily weighted toward systems and medical interventional solutions. Also, the company has witnessed a slowdown in orders with customers delaying delivery dates into the second half of this year.

Based on these factors, the company now expects revenue to either remain stable or increase by about 3%, compared with the previously provided outlook of 1% to 7% growth. Moreover, earnings are anticipated to be in the range of $8.75 to $9.50, compared with $8.75 to $10.10 per share prior guidance.

Is Nordson a Good Stock to Buy?

Wall Street analysts are bullish on NDSN stock and have a Strong Buy consensus rating, which is based on three unanimous Buys. The average price target of $269.67 implies 9.5% upside potential. The stock has gained 7.1% in the past three months.

Supporting the bull case is NDSN’s impressive dividend history. The company has been increasing payouts every year since 2009. Also, insiders are optimistic about Nordson as they have bought NDSN stock worth $3.4 million in the last three months.