Nomura Holdings (NMR) is moving to capture Japan’s fast-growing institutional crypto market. Its Switzerland-based subsidiary Laser Digital confirmed that it is in talks with regulators to secure a license for trading services.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

A spokesperson for Laser Digital told Cointelegraph that the company is in pre-consultation discussions with Japan’s Financial Services Agency. The application date is still undecided and will depend on the outcome of those talks. If approved, the license would allow Laser Digital to launch broker-dealer services for both traditional financial institutions and crypto-focused companies in Japan.

Institutions Push Deeper into Crypto

The expansion comes as Japan’s financial giants increase their exposure to digital assets.

Daiwa Securities, one of the country’s largest brokerages, recently introduced a crypto lending service that lets clients borrow yen against Bitcoin and Ethereum. Market analysts say these moves highlight the rising demand for institutional-grade crypto access in Japan.

Earlier this year Nomura and Laser Digital released a survey that showed more than half of investment managers, including family offices and corporations, expect to allocate to cryptocurrencies within the next three years. Executives at the firm believe this appetite is creating an opening for licensed companies to enter the market.

Regulators Shift Toward Favorable Rules

Japan’s regulatory climate is becoming more supportive.

Authorities are working on reforms to bring crypto oversight in line with securities market rules and are considering lower taxes on digital assets. In August the country approved its first yen-pegged stablecoin, which was seen as a breakthrough for blockchain-based finance.

The changes are already fueling adoption. A Chainalysis report found that Japan’s crypto activity grew 120 percent year over year in the 12 months to June, the strongest rise among Asia-Pacific’s largest markets.

Nomura Moves to Lead the Next Phase

Nomura’s push through Laser Digital shows how traditional financial leaders are preparing for the next wave of institutional adoption.

If regulators approve the license, Nomura would be positioned to provide regulated large-scale trading services and secure an early advantage in a market that is quickly shifting from retail speculation to institutional flows.

Nomura’s Laser Digital is in talks with Japan’s regulators to launch licensed crypto trading for institutions, as adoption surges and favorable rules drive demand from banks, brokerages, and asset managers.

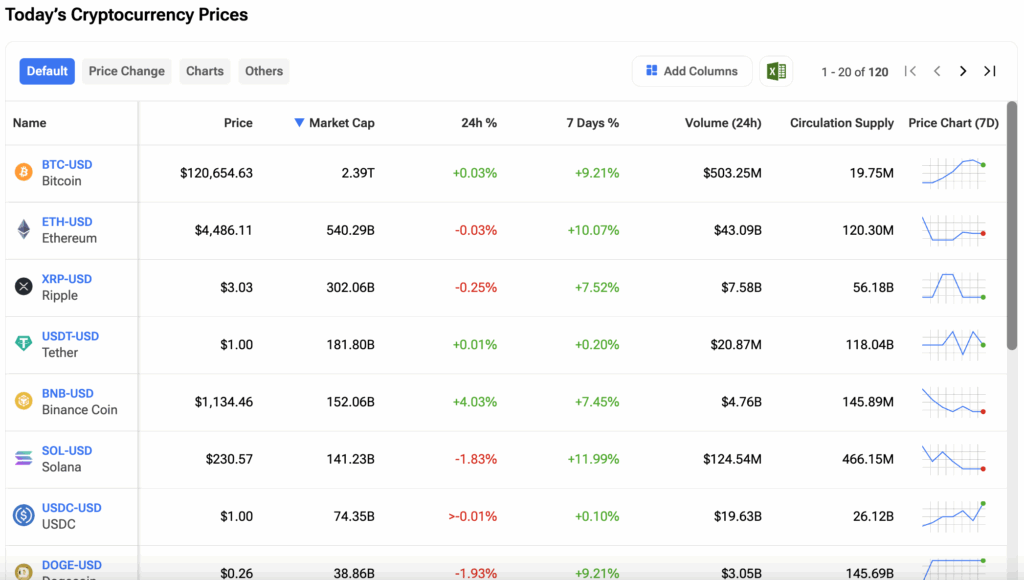

Investors should stay informed by tracking the prices of their favorite cryptos on the TipRanks Cryptocurrency Center.