Billionaire Elon Musk is set to interview presidential candidate Donald Trump on the social media platform X at 8:00 p.m. on Monday. In the buildup to the event, Elon Musk stated that the interview would be “unscripted with no limits on subject matter, so should be highly entertaining!”

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Although Musk once suggested that Trump should retire, the Tesla (TSLA) CEO has warmed up to him recently and endorsed Trump’s campaign for the White House. This is despite Trump’s past criticisms of all-electric trucks and semis and his opposition to some EV subsidies that have benefited Tesla.

However, Trump has since softened his stance on electric vehicles, stating at a recent campaign event that he now supports them, partly due to Musk’s endorsement. It remains uncertain how a potential Trump administration would support the EV industry. Some analysts think a tariff war with China could benefit Tesla (TSLA) in certain areas, though a full-scale trade war might hurt its China business.

In addition, given how polarizing of a figure Trump is, some may wonder how Musk’s endorsement could affect Tesla’s brand. Indeed, it could potentially harm its image among more left-leaning voters but may also improve its standing with conservative voters.

Investor Sentiment for TSLA Stock is Currently Very Negative

The sentiment among TipRanks investors is currently negative. Out of the 751,087 portfolios tracked by TipRanks, 15.5% hold TSLA stock. In addition, the average portfolio weighting allocated towards TSLA among those who do have a position is 13.86%. This suggests that investors of the company are very confident about its future.

However, in the last 30 days, 2% of those holding the stock decreased their positions. As a result, the stock’s sentiment is below the sector average, as demonstrated in the following image:

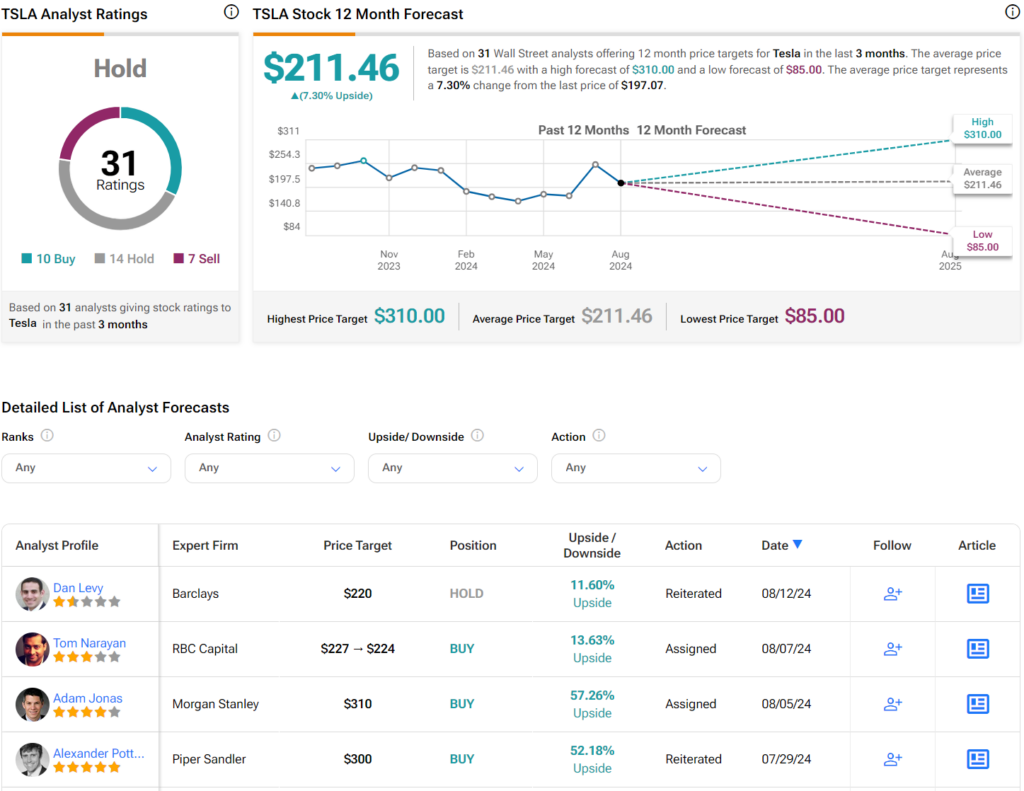

Is Tesla a Buy, Sell, or Hold?

Turning to Wall Street, analysts have a Hold consensus rating on TSLA stock based on 10 Buys, 14 Holds, and seven Sells assigned in the past three months. After a 21% year-to-date decline, the average Tesla price target of $211.46 per share implies 7.3% upside potential.