Chinese electric vehicle (EV) makers Nio (NIO) and XPeng (XPEV) impressed investors with their robust October deliveries, while Li Auto (LI) continued to struggle. Notably, Nio’s monthly deliveries passed the 40,000 units mark for the first time in October, while XPeng’s deliveries crossed this level for the second consecutive month. Nio stock was up 1.7% on Monday morning, as of writing, while XPEV stock gained 1.11%. Meanwhile, Li Auto stock was modestly up.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Nio and XPeng Report Robust October Deliveries

Nio delivered 40,397 vehicles in October 2025, reflecting 92.6% year-over-year growth and a 16.3% rise from the previous month. Notably, Nio’s October deliveries comprised 17,143 vehicles from the premium smart EV namesake brand (Nio), 17,342 vehicles of the Onvo sub-brand, and 5,912 vehicles from the Firefly sub-brand.

The company stated that its smart large-space flagship SUV, the Onvo L90, achieved a new record with monthly deliveries exceeding 10,000 for three consecutive months since it was officially launched in late July 2025. Moreover, Nio’s recently launched third-generation ES8 is seeing strong demand.

Meanwhile, XPeng’s October deliveries increased 76% year-over-year to 42,013 EVs, though the sequential growth was only 1%. The company continued to accelerate its global expansion in October by entering seven new markets across Europe, Asia, and Africa. Specifically, XPeng expanded into Lithuania, Latvia, Estonia, Cambodia, Morocco, Tunisia, and Qatar.

XPEV stock has rallied 99% year-to-date, driven by the EV maker’s consistent performance despite intense competition in the Chinese EV market. Meanwhile, Nio stock has risen 66.3% year-to-date. All eyes are now on XPENG AI Day on November 5, where the company will highlight its latest breakthroughs and future development roadmap for its in-house AI technology.

Li Auto Continues to Disappoint

Li Auto reported a steep 38.3% fall in its October deliveries to 31,767 units, marking the fifth consecutive month of declines. Moreover, Li Auto’s October deliveries were down 6.4% compared to September. The company has been facing weak demand for its flagship L-series extended-range electric vehicles (EREVs).

On August 5, Li Auto relaunched its Li i8 SUV with a reduced price following dismal initial reception. Further, the company launched its second pure-electric SUV, Li i6, on September 26. On the positive side, Li Auto highlighted that Li i6 has secured over 70,000 orders since its launch, and the company is taking all necessary steps to facilitate deliveries.

Meanwhile, Li Auto is also expanding its global presence. The company opened its first overseas-authorized retail store in Uzbekistan in October, offering the Li L9, Li L7, and Li L6 EVs. Two more stores are set to open in Kazakhstan in November. Li Auto stated that it plans to prioritize market expansion in Central Asia, the Middle East, Europe, and Asia-Pacific as it seeks growth beyond China.

Wall Street’s Ratings for NIO, XPEV, and LI Stocks

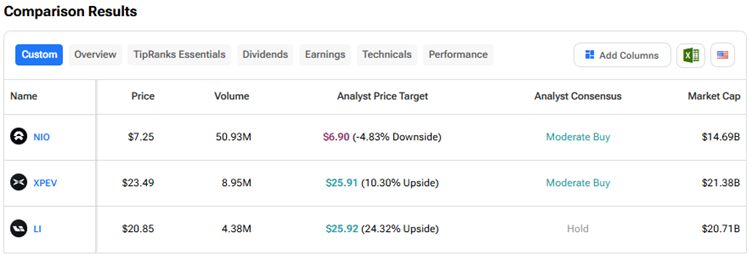

Using TipRanks’ Stock Comparison Tool, let’s look at Wall Street’s ratings on these three Chinese EV stocks.

Currently, Wall Street has a Moderate Buy consensus rating on Nio and XPeng stocks and a Hold rating on Li Auto. Following the solid year-to-date rally, analysts see downside risk in NIO stock but continued upside in XPEV stock.