Nio (NIO) shares trended lower in pre-market trading today after Singapore’s sovereign wealth fund, GIC, filed a lawsuit accusing the Chinese electric vehicle maker of inflating revenue and misleading investors. The case, filed in the Southern District of New York, also names CEO Li Bin and former CFO Feng Wei as defendants.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The lawsuit alleges that Nio improperly recognized more than $600 million in leased battery revenue through Weineng, described in the complaint as “a superficially independent” battery asset company that was actually controlled by Nio. The complaint claims Nio’s accounting misrepresented earnings, artificially boosting its market value and misleading shareholders.

Shares Drop as Legal Concerns Grow

GIC, which purchased Nio shares between August 11, 2022, and July 11, 2023, said it suffered significant losses due to the alleged misstatements. The lawsuit triggered a broad sell-off in Nio’s stock.

Hong Kong-listed shares fell about 7.9%, while U.S.-listed ADRs slipped more than 8% in pre-market trading on Thursday. The case adds to pressure on Chinese EV makers already struggling with slower demand and rising competition in global markets.

Nio has not yet responded to the allegations. Analysts believe the case could weigh on investor sentiment in the near term, keeping the company’s financial reporting under close scrutiny.

Is NIO a Buy, Sell, or Hold?

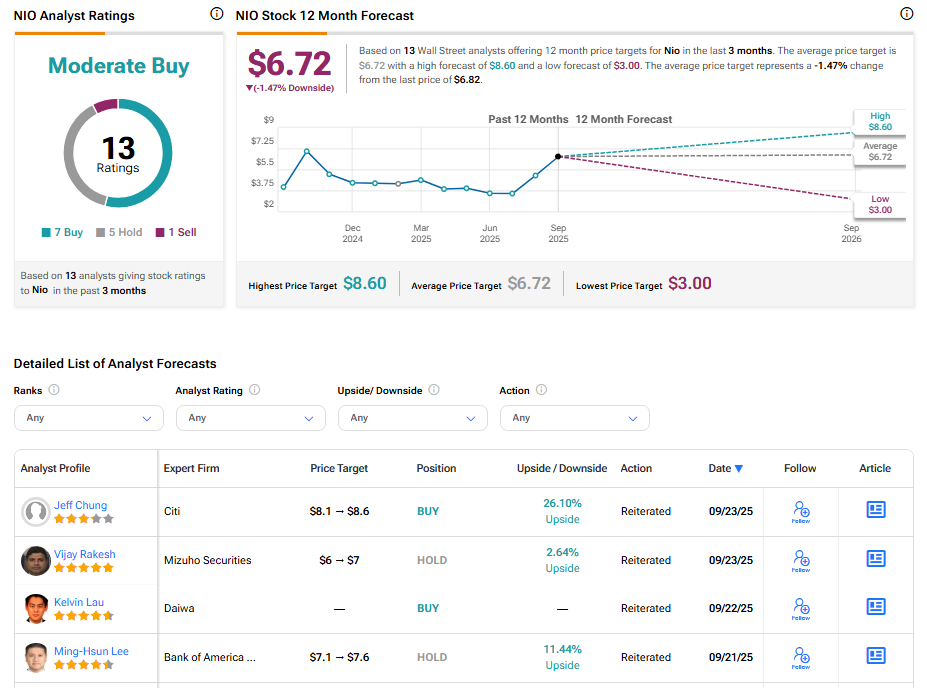

Overall, Wall Street has a Moderate Buy consensus rating on NIO stock, based on seven Buys, five Holds, and one Sell assigned in the last three months. The average NIO stock price target of $6.72 implies 1.47% downside potential from current levels.