IO (NYSE: NIO) delivered a familiar mix of progress and pain in its Q1 2025 earnings. The Chinese EV maker posted strong year-over-year growth in deliveries and gross profit, but deep losses continue to define the story. Margins are improving and new models are rolling out, but the path to profitability still stretches out like a horizon that never seems to get any closer. In the meantime, most analysts don’t expect NIO to break even before 2027.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Good

The company delivered 42,094 vehicles in the quarter, representing a 40% increase from the same period last year. This included 27,313 vehicles under the flagship NIO brand and 14,781 under ONVO, its new family-oriented brand. However, deliveries dropped 42% from the prior quarter due to seasonality and model transitions.

Total revenue for the quarter reached RMB 12.03 billion or $1.66 billion. That was up 21% from a year ago but down nearly 39 % from Q4. Gross profit jumped 88% year-over-year to RMB 920 million or $127 million. Gross margin improved to 7.6% from 4.9% in Q1 2024. Vehicle margin rose to 10.2%, up from 9.2% a year ago.

Although the chart below doesn’t include Nio’s latest quarter, the growing deliveries of vehicles is evident.

The Bad

Despite these improvements, the net loss came in at RMB 6.75 billion, or approximately $930 million. That was 30% wider than the same period last year. On a non-GAAP basis, the adjusted net loss was RMB 6.28 billion. Selling, general, and administrative expenses rose 47% year-over-year. Research and development spending increased 11%. The company ended the quarter with RMB 26 billion, or approximately $3.6 billion, in cash and equivalents.

Management guided for second-quarter deliveries between 72,000 and 75,000 vehicles. This would represent a growth of 25 to 31% from the same period last year. Several new models were launched in April and May, including the Firefly compact EV and upgraded versions of the ES6, EC6, ET5, and ET5T.

NIO’s battery swap infrastructure remains a key strength. The company operates over 2,500 battery swap stations in China and is expanding the service in Europe. This system allows drivers to exchange batteries in minutes rather than wait to charge. The battery swap service, power solutions, and used car sales are driving growth in NIO’s “Other Sales” category, which increased 37 % year-over-year.

The Complicated

These services continue to operate at a loss. Management expects the battery swap segment to reach breakeven by 2026 or 2027. Profitability for the overall business is not likely before 2027, based on current analyst estimates. The company continues to invest in proprietary smart driving chips and its full-stack software platform. These technologies are being deployed through the new “NIO World Model” operating system, which started rolling out in May.

NIO is showing early signs of improved operational efficiency. Margin gains and product diversity are positive. But consistent profitability remains years away. The company is burning cash, carrying negative shareholder equity, and spending heavily to support new product launches and infrastructure. Execution on cost control and service monetization will be critical as the year progresses.

Is NIO a Good Stock to Buy?

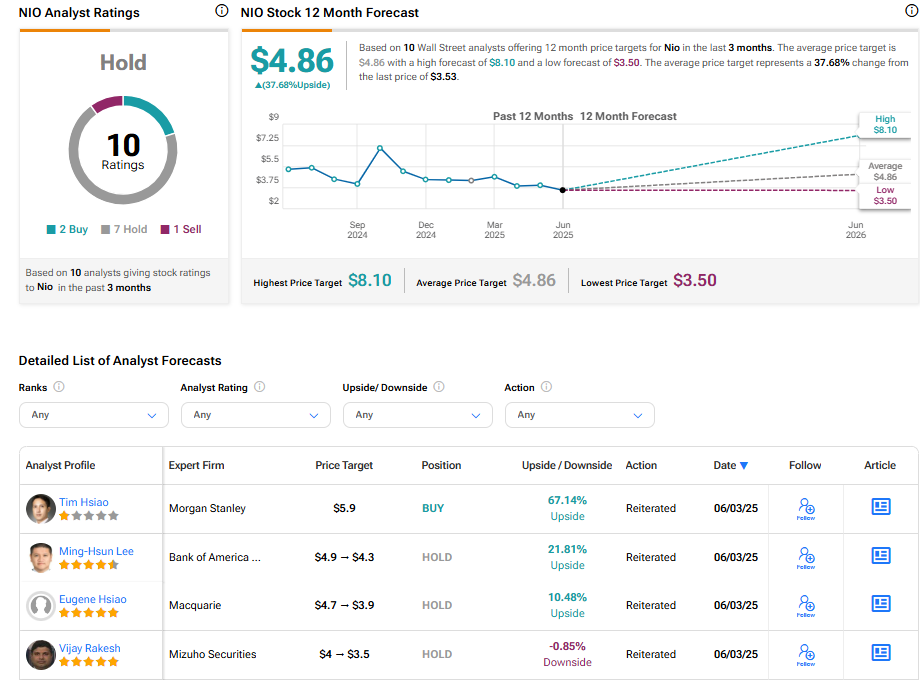

According to 10 analysts’ ratings, Nio is a Hold, with an average NIO stock price target of $4.86. This implies a 37.68% upside.