Shares of Chinese EV maker NIO (NYSE:NIO) are trending nearly 4% higher in the early session today after the company announced a mixed set of third-quarter numbers. Despite a 46.6% year-over-year increase, revenue of $2.61 billion lagged expectations by nearly $50 million. On the other hand, net loss per American Depository Share of $0.31 came in narrower than estimates by $0.05.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

During the quarter, total vehicle deliveries jumped by 135.7% to 55,432 units sequentially. Of these, 37,585 were premium smart electric SUVs and 17,847 were premium smart electric sedans. Although higher selling prices and cost reduction initiatives helped improve the company’s vehicle margin to 11% from 6.2% in the second quarter, the figure still lagged the 16.4% mark reached in the year-ago period.

Similarly, NIO’s overall gross margin of 8% remained lower compared to the year-ago figure of 13.3%. Its net loss for the quarter increased by 10.8% year-over-year to $624.6 million. Separately, NIO has agreed to acquire certain manufacturing equipment and assets from Anhui Jianghuai Automobile Group Corp. (JAC) for RMB 3.16 billion.

Looking ahead to the fourth quarter, NIO expects total revenue to be in the range of $2.2 billion to $2.29 billion. Vehicle deliveries for the quarter are anticipated between 47,000 and 49,000. The company delivered nearly 36,000 vehicles in October and November.

What Is a Good Target Price for NIO?

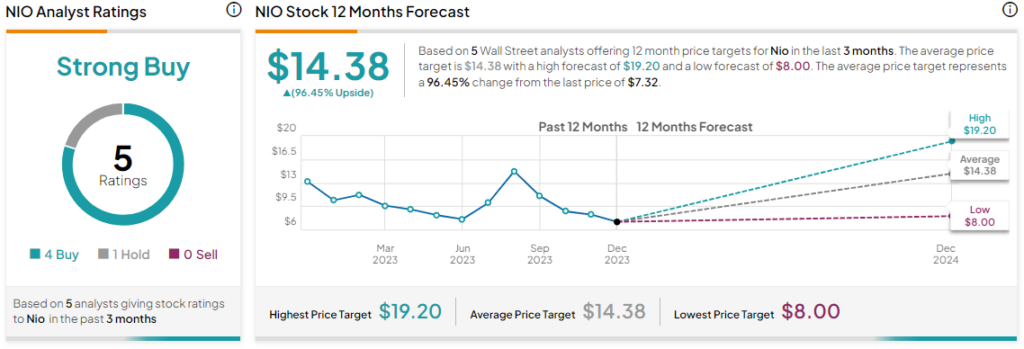

Overall, the Street has a Strong Buy consensus rating on NIO and the average NIO price target of $14.38 implies a substantial 96.5% potential upside. That’s after a 24% price decline in NIO shares so far this year.

Read full Disclosure