Shares of Chinese EV maker NIO (NYSE:NIO) are in focus today after the company closed a $2.2 billion strategic equity investment from CYVN Investments.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

This strategic liquidity injection from Abu Dhabi-based CYVN, a specialist investment Vehicle with a focus on smart and advanced mobility solutions, comes at a time when competition in the Chinese EV market remains fierce, and NIO’s vehicle sales are falling short of expectations.

In July, CYVN poured $738.5 million into NIO and acquired NIO shares from an affiliate of Tencent Holdings (OTC:TCEHY) for about $350 million. Following the latest purchase, CYVN will hold a nearly 20.1% stake in NIO. Additionally, it can nominate two directors to NIO’s Board. Further, the two companies, along with their affiliates, plan to pursue strategic and technology collaborations in international markets.

Earlier, NIO unveiled its luxury EV offering, the ET9. Priced at around $112,000, the vehicle offers a 255 KM range on a five-minute charge. The sedan is available for pre-order in China, with deliveries anticipated to begin in Q1 2025. NIO also plans to launch its Firefly and Alps brands in Europe over the coming periods.

The company has been consistently incurring losses and recently announced a 10% headcount reduction. According to CarNewsChina, NIO sold 4,100 EVs during the week ended December 24. That’s significantly lower than Tesla’s (NASDAQ:TSLA) 18,500 and BYD’s (HK:1211) (OTC:BYDDF) 63,900 vehicle sales during this period.

What is the Prediction for NIO Stock?

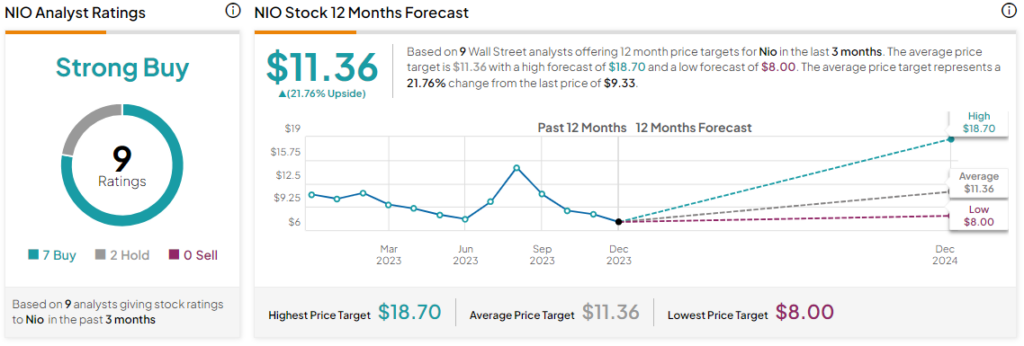

Shares of the company have surged nearly 27% over the past month. Overall, the Street has a Strong Buy consensus rating on NIO, and the average NIO price target of $11.36 points to a 21.8% potential upside in the stock.

Read full Disclosure