Nio Ltd. said that it shipped 3,965 vehicles last month, reflecting a 104.1% year-over-year increase. Between January and August this year, car deliveries soared 109.9% to 21,667 vehicles on a year-on-year basis.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Nio (NIO) CEO William Bin said, “In August, we achieved our best-ever monthly performance on both deliveries and order growth.” He further stated, “As we continue to improve the production capacity for all Nio products, our monthly capacity will reach 5,000 units in September to support our future deliveries.”

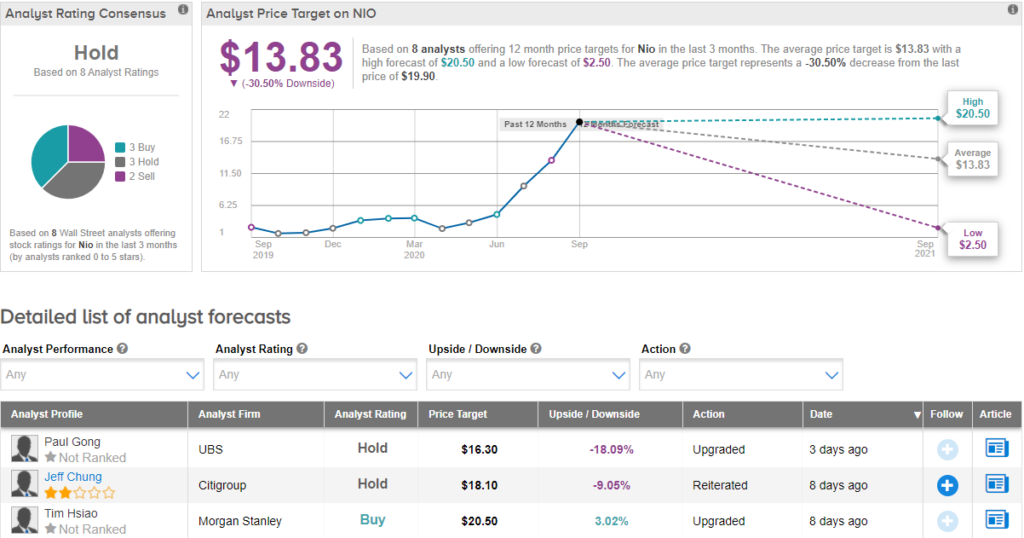

On August 26, Citigroup analyst Jeff Chung lifted the stock’s price target to $18.10 (9% downside potential) from $16, but reiterated a Hold rating. Following a call with management, Chung stated that Nio’s battery as a service model and production ramp up indicates higher volume growth. He also raised the sales volume growth projections for the next three years. (See NIO stock analysis on TipRanks).

With shares up 395% year-to-date, the Street has a cautious outlook on the stock. The Hold analyst consensus is based on 3 Holds, 3 Buys, and 2 Sells. The average price target of $13.83 implies downside potential of about 31% to current levels.

Related News:

Nio To Sell 75M Shares; Stock Drops 7%

Tesla Slides As Top Holder Reduces Stake; Merrill Lynch Sees 23% Upside

Copart Gains 4% in After-Hours On Quarterly Sales Win