Athletic apparel company Nike (NKE) is starting to make progress on its turnaround plan, but CEO Elliott Hill says it will take time before the company returns to strong and profitable growth. Indeed, in an interview with CNBC’s Sara Eisen, Hill talked about how complex the business has become, as it now covers three major brands, several sports categories, and operates in 190 countries. In addition, each region and sport is in a different stage of development, which means that the turnaround won’t be quick or follow a straight path. Still, Hill believes Nike has a clear direction forward.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

It is worth noting that Hill became CEO nearly a year ago and has since rolled back many of the changes made by former CEO John Donahoe, who had pushed for more direct-to-consumer sales through Nike’s own stores and website. While that strategy worked well during the pandemic, Hill says it became less effective once in-person shopping returned. To fix this, Nike is rebuilding relationships with wholesalers and looking to win back shelf space that was lost to competitors. The company is also partnering with new retailers like Aritzia (ATZAF) to reach more female customers.

Another major change Hill is making is reorganizing Nike’s business by sport instead of by customer category (men’s, women’s, and kids’). This brings back Nike’s older structure and is meant to help teams focus more directly on the needs of athletes in each sport. However, while these changes look promising, Nike still faces some big challenges. Indeed, the company recently warned that tariffs will now cost it $1.5 billion this year, rather than $1 billion, which will reduce its profit margins. Nevertheless, Hill said that Nike is working with suppliers, factories, and retail partners to manage the impact.

Is NIKE Stock a Buy, Sell, or Hold?

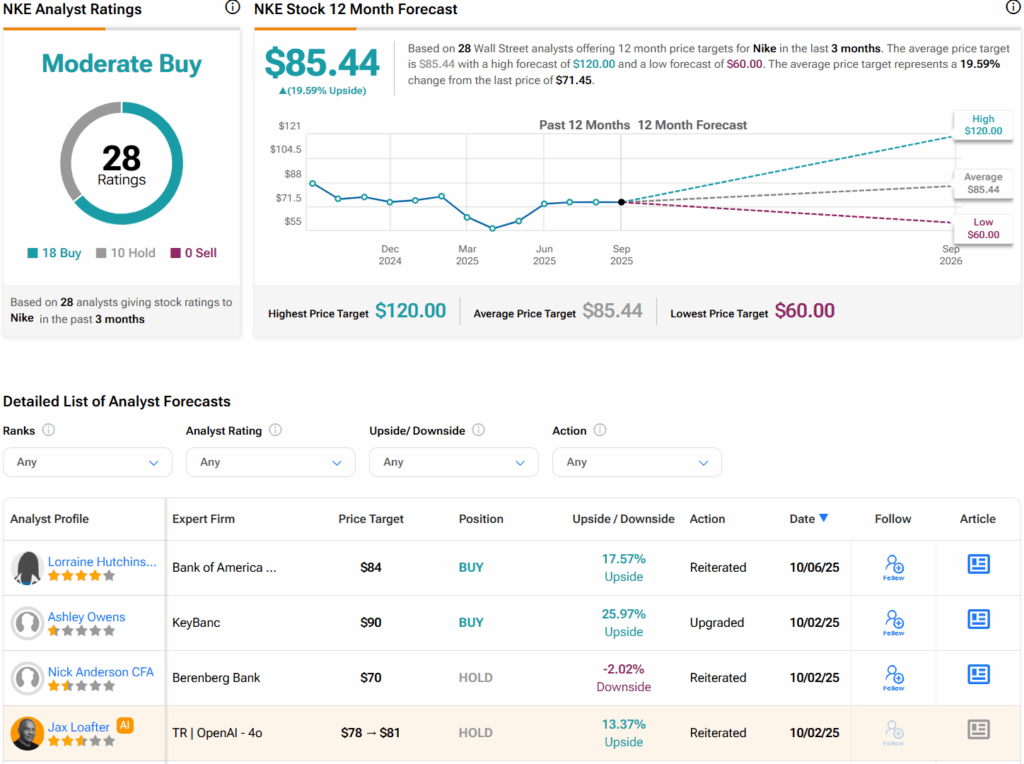

Turning to Wall Street, analysts have a Moderate Buy consensus rating on NKE stock based on 18 Buys, 10 Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average NKE price target of $85.44 per share implies 19.6% upside potential.