Shares of sportswear giant Nike (NKE) gained 3.3% in after-hours trading yesterday. The upside came after Bill Ackman’s Pershing Square Capital Management acquired a stake in the company during Q2. Per the latest 13F filing, the investment firm bought 3 million shares, valued at $229 million.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

It’s worth noting that Ackman had previously bought a stake in Nike in late 2017. However, he exited the position with a $100 million profit the following year.

Interestingly, Ackman’s recent investment comes amid Nike’s ongoing challenges with slowing sales growth and increased competition. The stock experienced a significant sell-off on June 27, declining 20% after a disappointing revenue forecast for the current fiscal year.

Other Portfolio Adjustments

Alongside its investment in Nike, the firm acquired a stake in investment management company Brookfield (BN) of nearly 7 million shares, worth $285 million, at the end of the second quarter.

Meanwhile, Pershing Square decreased its stakes in several existing holdings. The firm reduced its position in long-time investment Chipotle Mexican Grill (CMG) by 23% and trimmed its holdings in Alphabet’s Class A (GOOGL) and Class C (GOOG) shares.

What Is the Outlook for NKE Stock?

Nike’s focus on expanding its direct-to-consumer business and managing inventory levels is encouraging. Further, its efforts to innovate new products and implement cost-cutting measures could bolster its performance. However, intense competition in the retail sector continues to be a key concern.

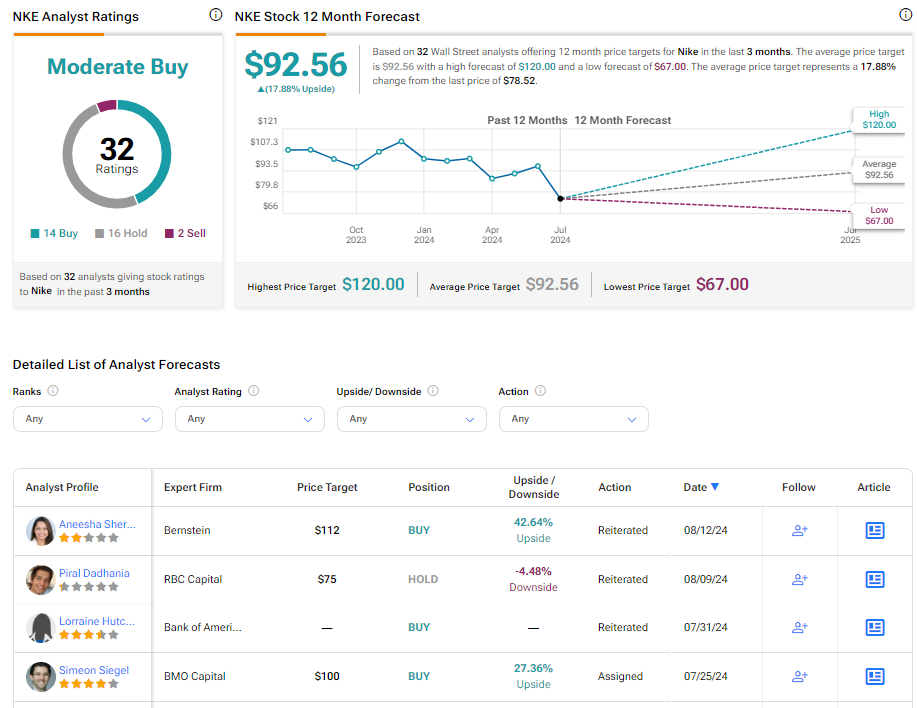

On TipRanks, NKE has a Moderate Buy consensus rating based on 14 Buy, 16 Hold, and two Sell recommendations assigned in the past three months. The analysts’ average price target on Nike stock of $92.56 implies 17.88% upside potential. Shares of the company have declined 25.4% in the past six months.