Shares of Nike (NKE) have been gaining momentum recently as more Wall Street analysts signal a potential turnaround for the apparel and footwear company. Williams Trading, led by five-star analyst Sam Poser, who was previously bearish, has turned bullish and double upgraded NKE from Sell to Buy and bumped his price target from $67 to $93 per share. Notably, he has an 83% success rate on the stock with an average return of 25% per rating.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

This change of sentiment was due to the rehire of Tom Peddie as VP of Marketplace Partners. Peddie’s return has been well-received by Nike’s wholesale partners, who are noticing more focused attention on their accounts.

In addition, Evercore ISI added Nike (NKE) to its softlines top five list earlier this week and suggested that the company could be nearing a fundamental bottom after several downward revisions. 4.3-star analyst Michael Binetti noted that Nike has begun taking crucial steps toward a turnaround, though it will be a complex process that will take time to unfold. He also mentioned that Nike has strengthened its marketing leadership, with early signs indicating a more impactful approach.

It’s worth noting that Binetti also has a solid track record on NKE stock, with a 63% success rate and an average return of 11.88% per rating. Currently, he has a Buy rating with a $105 price target.

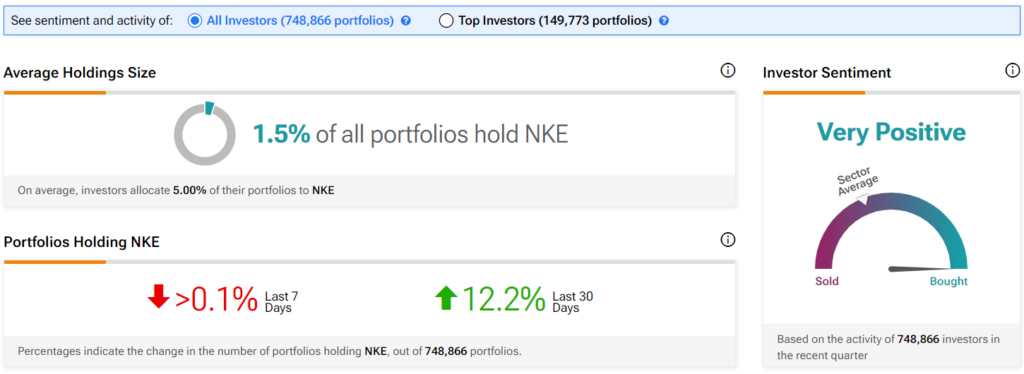

Investor Sentiment for NKE Stock Is Very Positive

Interestingly, it seems like analysts aren’t the only ones who are warming up to Nike. In fact, the sentiment among TipRanks investors is currently very positive. Out of the 748,866 portfolios tracked by TipRanks, 1.5% hold NKE stock. In addition, the average portfolio weighting allocated towards NKE among those who do have a position is 5%. This suggests that investors of the company are fairly confident about its future.

However, the most interesting part is that in the last 30 days, 12.2% of those holding the stock increased their positions. As a result, the stock’s sentiment is well above the sector average, as demonstrated in the following image:

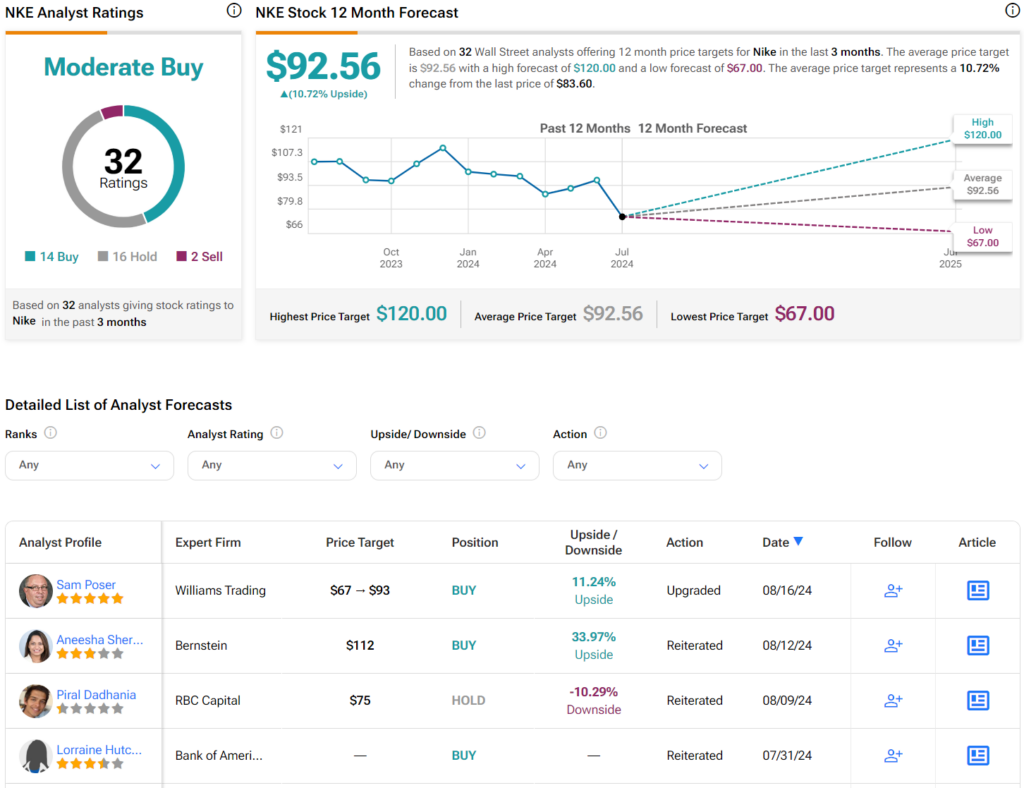

Is NIKE Stock a Buy, Sell, or Hold?

Turning to Wall Street, analysts have a Moderate Buy consensus rating on NKE stock based on 14 Buys, 16 Holds, and two Sells assigned in the past three months, as indicated by the graphic below. After a 19% decline in its share price over the past year, the average NKE price target of $92.56 per share implies 10.72% upside potential.