The 2024 Summer Olympic Games will be starting up in earnest in just a couple months, at the end of July. And it’s no surprise that shoe titan Nike (NYSE:NKE) has been gaining on the strength of that event. But new products didn’t hurt, either, and Nike is up modestly in the closing minutes of Monday’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Nike’s Blueprint Pack, featuring a total of 13 new kinds of shoes for soccer, track, basketball, and general lifestyle wear, was brought out at a show in Paris. While each was a draw in its way, the clear winner of the show was the Pegasus, which got its 41st version put on display.

The Pegasus is widely considered to be one of Nike’s premium brands, if not its flagship brand. The latest version in the line, the Pegasus Premium, was called by industry watchers an “…upgraded and elevated take on one of the brand’s most recognized and celebrated running shoes.” Customers, meanwhile, will be able to purchase these starting in June.

All This and a Channel Marketing Pivot Too

Nike came out with a mea culpa today, as it revealed that it may have gone a bit too far with its emphasis on direct-to-consumer (DTC) channel distribution. In fact, it kind of left its wholesalers out in the cold, for which its CEO, John Donahoe, apologized before making it clear that its wholesalers and retail partners would be brought back into the fold.

Nike backed that up with investment, which Donohoe elaborated as Nike “…investing heavily with our retail partners.” Without wholesalers and retailers supporting the operation, Nike quickly discovered that it had to spend a lot more to draw customers, and that took a lot of the shine off the savings of focusing on DTC.

Is Nike Stock a Buy, Sell, or Hold?

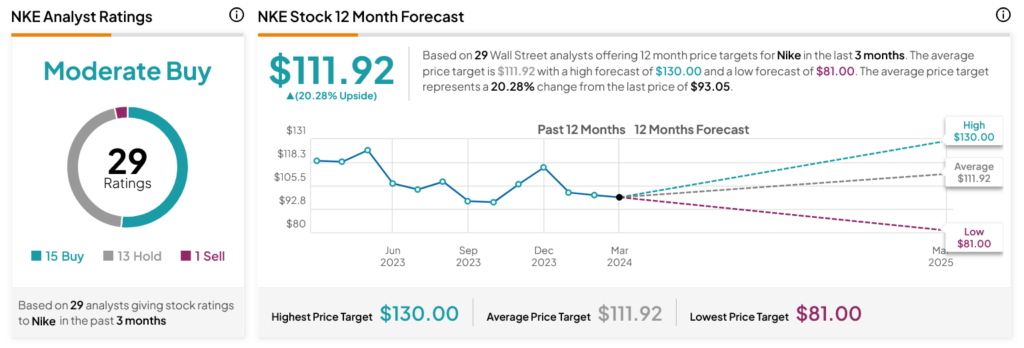

Turning to Wall Street, analysts have a Moderate Buy consensus rating on NKE stock based on 15 Buys, 13 Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 25.31% loss in its share price over the past year, the average NKE price target of $111.92 per share implies 20.28% upside potential.