Shares of cloud and on-premises enterprise software solutions provider NICE Ltd. (NICE) are in the red so far today despite robust Q2 earnings results, marked by margin expansion and upbeat guidance.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

On the back of a 27.9% jump in Cloud revenue, total non-GAAP revenue increased 15.6% year-over-year to $530.6 million, outperforming expectations by $5.5 million. EPS of $1.86, too, beat the consensus by $0.07. The company had generated an EPS of $1.57 in the comparable year-ago period.

Additionally, while its total gross margin expanded to 73.3% from 72.2% a year ago, the operating margin increased to 29% from 28.2% a year ago.

Importantly, the company now has 83% recurring revenue, driven by its cloud business. The CEO of NICE, Barak Eilam, remarked, “For many years now, we have successfully employed a bulls-eye strategy around cloud, platform, and next-gen digital. The harmonization of these three elements is what the market is now experiencing more than ever, and we are at the center of it.”

Looking ahead, NICE expects revenue to land between ~$2.17 billion and ~$2.19 billion in 2022. EPS is anticipated to range from $7.33 to $7.53. In comparison, NICE had earlier guided for a revenue range of $2.16 billion and $2.18 billion and EPS between $7.25 and $7.45.

Is NICE Stock a Buy?

JMP Securities analyst Patrick Walravens is optimistic about the stock, with a Buy rating and a price target of $343, implying 55% upside potential. NICE’s Smart Score of 8 out of 10, too, indicates that the stock could outperform the market in the coming periods.

Overall, the Street has a Strong Buy consensus rating on the stock alongside an average price forecast of $265.20, which implies 19.8% upside potential.

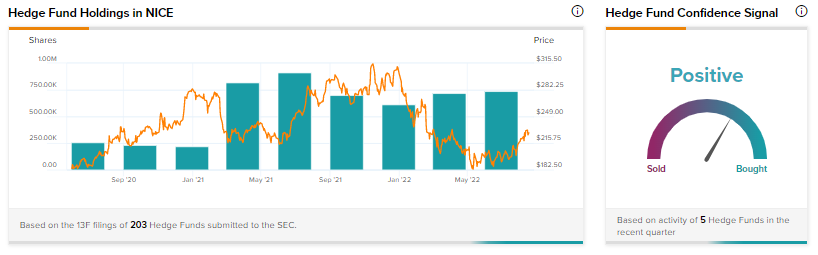

Hedge funds, too, are sharing this optimism and have increased their NICE holdings by 22,800 shares in the last quarter. This indicates a positive hedge fund confidence signal in the stock. Furthermore, Andrew Law’s Caxton Associates and Catherine Wood’s ARK Investment have both added to their NICE positions recently.

Conclusion: NICE’s Cash Flow Should Attract Investors

In a world that is increasingly AI-driven, NICE’s solutions continue to make gains. While NICE shares aren’t exactly cheap, with a price-to-earnings multiple of 68.9x, a cloud company with a positive price-to-free cash flow ratio of 30.8x should definitely gain investor attention.